Why invest in bonds?

E*TRADE from Morgan Stanley

02/14/25Summary: Bond investing doesn’t have to be complicated. Here’s what you need to know to invest in the fixed income market.

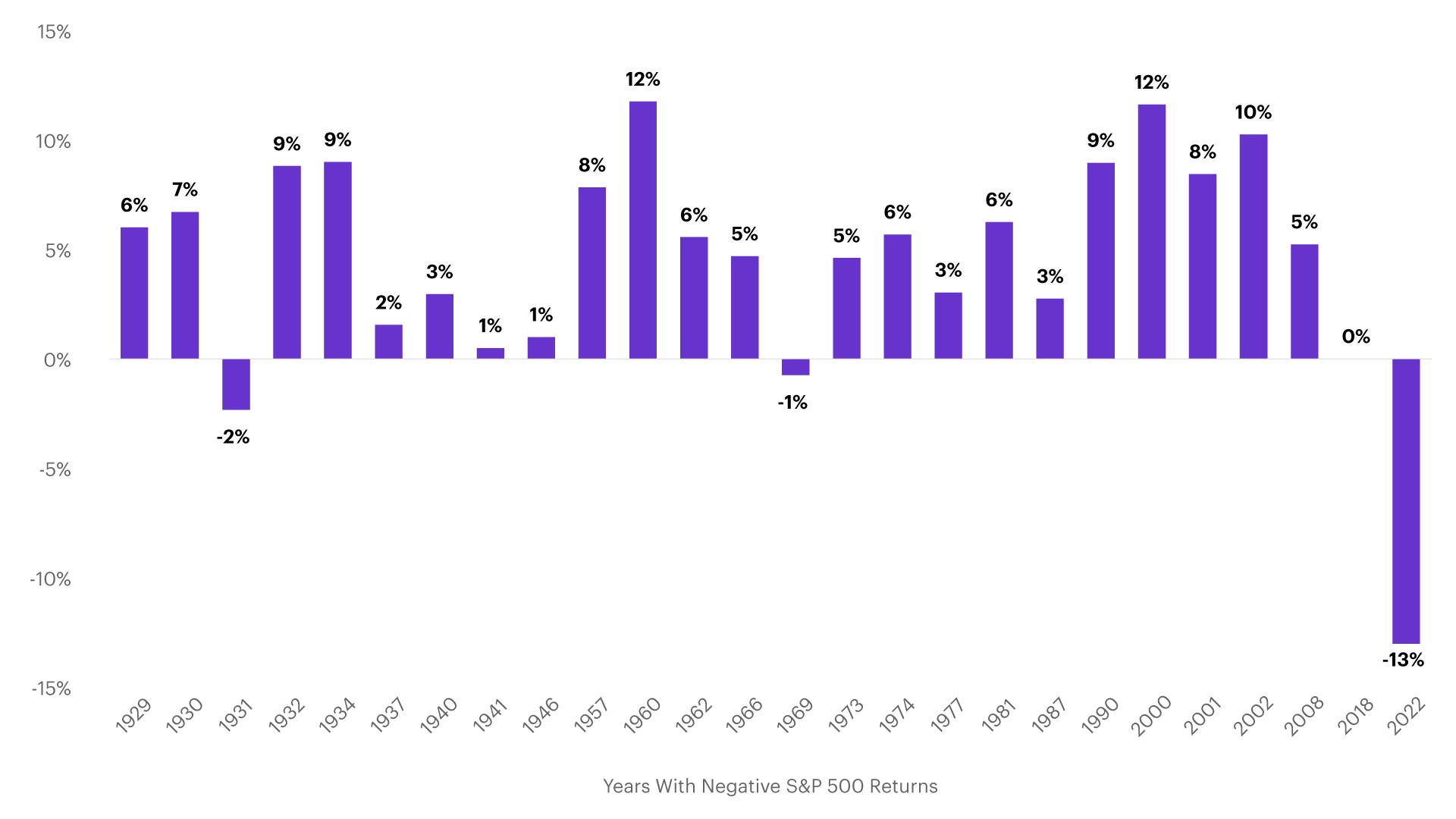

Bond total returns (1923 – 2023): Stocks had 26 down years over the past century - bonds were positive in 23 of them.1 Note that past performance is not indicative of future results.

Some fixed income investors may find bond investing intimidating because they don’t understand how bonds work. Though they may seem complex, the bond market is actually a lot simpler than one could expect. Understanding how this important asset class works can go a long way towards helping investors diversify their portfolio and take advantage of investment opportunities.

How do bonds work and where can I purchase them?

Bonds are sold by various issuers—namely companies, governments, and municipalities—to raise money to fund ongoing expenses and finance operations.

An investor who buys a bond is essentially making a loan to the issuer of the bond. In return, the borrower (issuer) is obligated to adhere to the terms of the loan. These terms may vary, but an investor typically receives fixed interest payments on stated dates and a return of their principal at the end of the loan period, which is when the bond matures.

Investors can purchase bonds on either the primary or secondary market using a brokerage account.

- In the primary market the original sale of a bond (a “new issue”) is made directly between the issuer and the investor. New issues are typically purchased at face value (also known as par value) in denominations of $1,000.

- If you want to sell your bonds prior to maturity, that would be done on the secondary market, if available, where you may incur a gain or loss on the sale of your bonds. You may purchase bonds on the secondary market by transacting with another investor or securities dealer through a typical brokerage account.

What are the benefits of investing in bonds?

Bonds are incredibly versatile and can be used to achieve a wide variety of investment objectives.

- Diversification/risk mitigation: Allocating a segment of your holdings to fixed income securities is a common method to diversify and reduce overall portfolio risk. In times of market turmoil, bonds typically experience less price volatility and can help hedge against an equity market downturn.

- Principal preservation: Sometimes, your goal is to simply not lose your initial investment. If that’s your objective, bonds can be a key component of your strategy as the bond’s principal (face value) is usually returned on the set maturity date. It might not have the glamor of a skyrocketing tech stock, but in the market, sometimes slow and steady wins the race.

- Income generation: This is another big reason why investors choose bonds—you can get paid interest. Bonds can reward investors with recurring interest payments for lending their money to an issuer for a stated period of time. Many investors rely on the predictability of interest payments from bonds to supplement their regular income stream.

- Tax advantages: Some fixed income investments such as municipal bonds can offer investors potential tax advantages. If investors purchase municipal bonds from an issuer in their state of residence, the interest income may be exempt from federal, state, and local taxes.

What are the common risks of investing in fixed income?

Although bonds are generally less risky than stocks and other investment choices, they still carry some risks that you should be aware of.

| Risk | What to consider |

|---|---|

| Credit/default: This is the risk that the issuer will be unable to make the bond’s interest or principal payments when they are due. | Consider investment grade bonds. Bonds that are rated higher by a credit rating agency are typically less likely to default. |

| Interest rate: Interest rates move inversely with bond prices, so as interest rates rise, the price on your existing bond will fall. Rising interest rates pose a risk to bond holders because they may reduce the market value of your bonds. | Using a bond ladder can help lessen interest rate risk by creating a portfolio of fixed income securities that mature at regular, staggered intervals. You can build a bond ladder online in just three easy steps using our Bond Ladder Builder (post-login). |

Call and reinvestment risk: If you buy a callable bond, you run the risk of your bond being called in early by the issuer. This is more prevalent when interest rates are declining. If called, you will receive your principal payment back prior to the bond’s maturity, generally with a premium slightly above par. |

When looking for a subsequent bond investment, it might be difficult to find comparable yields at an equivalent credit rating—known as reinvestment risk. To reduce call and reinvestment risk, you may want to consider noncallable bonds. |

| Liquidity risk: You may encounter liquidity risk if you are looking to sell your bond prior to maturity for the same price you paid for it. Generally, this is more prevalent for bonds with thinly traded markets. | To reduce exposure to liquidity risk, consider more liquid bonds such as US Treasuries or corporates, which feature more active markets. |

Fixed income investors looking to add a lower-risk, short-term investment to their portfolio could look to Brokered CDs.

What are the different types of fixed-income securities?

In the bond market, you will often hear terms such as municipals (or “munis”), corporates, or Treasuries (typically T-bills, notes, and bonds). These are all types of bonds available to purchase. Each has their own benefits, characteristics, and risks. In a nutshell:

Corporates

Corporate bonds are issued by public or private corporations. Corporations typically issue bonds to help finance general business expenses, expand operations, or provide a source of funding for acquisitions. Corporate bonds generally carry more risk but offer higher yields in return.

Government bonds

Government bonds include those issued by the US government and other government sponsored agencies, such as:

A) Treasuries

Treasury bonds are backed by the full faith and credit of the United States government. As a result, they are generally considered to be the safest bond investments. Due to their high credit quality and low risk profile, Treasury bonds typically offer lower yields compared to other investments. Interest income from Treasury bonds is usually exempt from state and local taxes and is only subject to federal taxes. The US Treasury issues new bonds with varying maturities from four weeks to over 10 years at regularly scheduled auctions. You can view the Treasury Auction Schedule to see when the Treasury is issuing new bonds. You can also buy and sell Treasuries on our Bond Resource Center at any time.

B) Agencies

Agency bonds are issued by one of two types of entities:

- Federal government agencies, such as the Government National Mortgage Association (Ginnie Mae).

- US government-sponsored enterprises (GSEs) that fund public projects. GSEs are typically federally chartered, privately owned companies serving a public purpose, such as the Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac).

Agency bonds typically offer higher yields than comparable Treasury bonds. While agency bonds issued by federal agencies are backed by the full faith and credit of the US government, agency bonds issued by GSEs are not—and are therefore subject to greater credit risk.

C) Municipals

Municipal bonds are issued by states, cities, counties, and other local governments to help fund public projects. Municipal bonds are popular amongst bond investors due to their tax advantages. Most municipal bonds are tax-exempt at the federal level and may offer tax exemptions at state and local levels for residents of the issuing state.

How can I analyze bond performance?

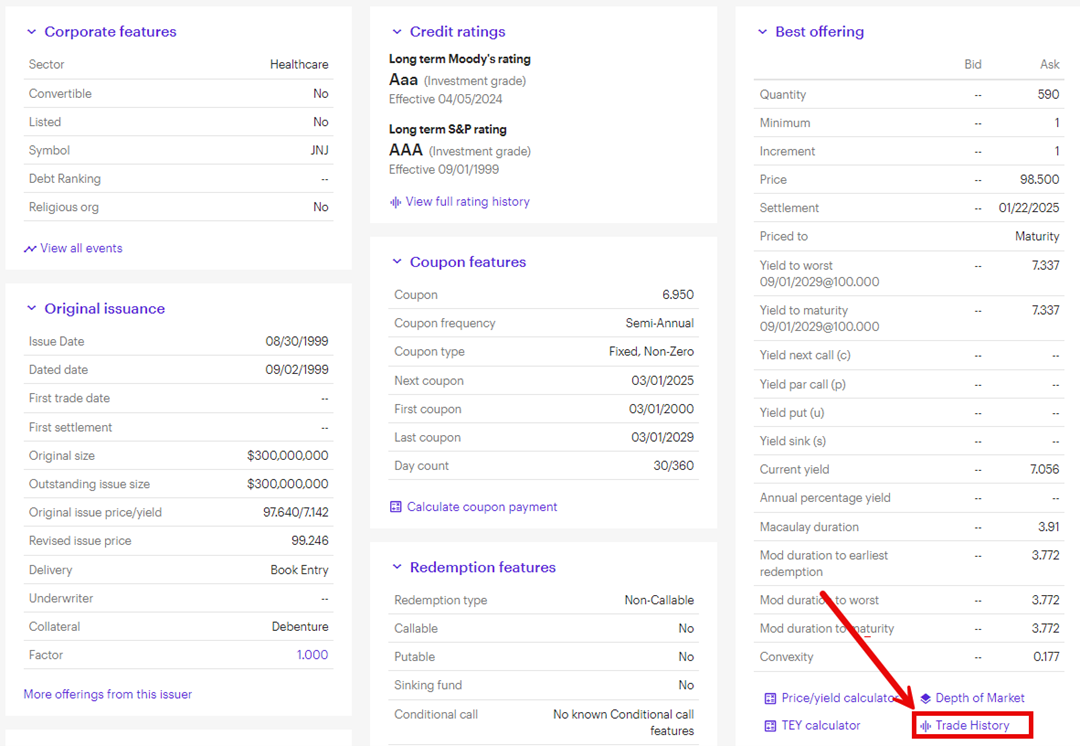

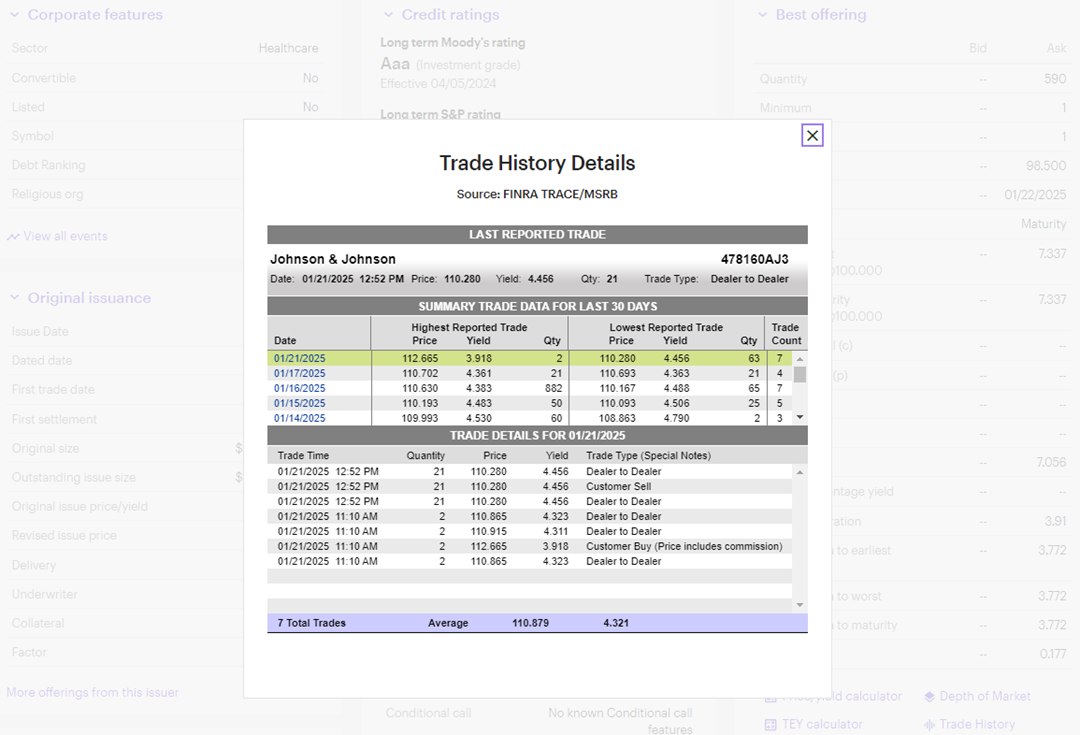

Bond trade history is a record of bond transactions, including the price, quantity, execution time, and yield. It can be used to analyze the performance of bonds and the bond market.

Once you’ve logged-in and run a search query within the Bond Resource Center, you can click any bond issuer name within your search results to access an offering’s Bond Detail Page. Then, click the Trade History link to open a pop-up box with the TRACE/MSRB2 feed. Example below.

Article Footnotes

1 Source: Robert J Shiller, Bloomberg, Morningstar Ibbotson, Morgan Stanley Wealth Management Global Investment Office.

Bonds represented in the chart prior to 1976 are based on the performance of “US Intermediate Government Bonds”, which used medium maturity term bonds as a benchmark. Bonds after 1976 are based on the “Bloomberg US Aggregate Index” which includes investment-grade bonds.

2 TRACE (Trade Reporting and Compliance Engine) is used to facilitate the mandatory reporting of over-the-counter secondary bond market transactions. MSRB (Municipal Securities Rulemaking Board) is an organization designed to protect the public interest by promoting a fair and efficient municipal bond market.

CRC# 4160446 02/2025

How can E*TRADE from Morgan Stanley help?

Need help getting started with bonds?

To get started with bonds, visit our comprehensive Bond Resource Center. Use our Advanced Screener to quickly find the right bonds for you. Or call our Fixed Income Specialists at (877-355-3237) if you need additional help.

Bonds and CDs

These investments pay regular interest and typically aim to return 100% of their face value at maturity. Choices include everything from U.S. Treasury, corporate, and municipal bonds to FDIC-insured certificates of deposit (CDs).