How should investors think about long term bitcoin returns?

Morgan Stanley Wealth Management

10/17/24Summary: As several new bitcoin exchange-traded funds become available, how should investors expect bitcoin to perform in the coming decade? Here’s a framework to consider.

Key Takeaways:

- Bitcoin’s remarkable 49% average annual return over the last 10 years is unlikely to be repeated in the next decade.

- Investors can try to forecast bitcoin’s long-term returns using factors such as bitcoin’s supply, demand and assumptions on penetration.

- Under four different assumptions, the 10-year annualized return estimates range from a more bearish 1% to a more aggressive 10%.

- Some potential risks to investing in cryptocurrencies include broken encryption, software bugs, adverse government action, or loss of the entire investment.

Why does bitcoin matter to investors today?

Bitcoin, the world’s largest cryptocurrency, has been making headlines lately with its volatile price movements and the recent launch of several bitcoin exchange-traded funds (ETFs). It has evolved from being thought of as purely a payment system to owners choosing to hold bitcoin for its store-of value properties1 and its allure as a financial asset. This has many investors wondering: How might bitcoin potentially fit into my portfolios and how can I go about estimating its performance from here?

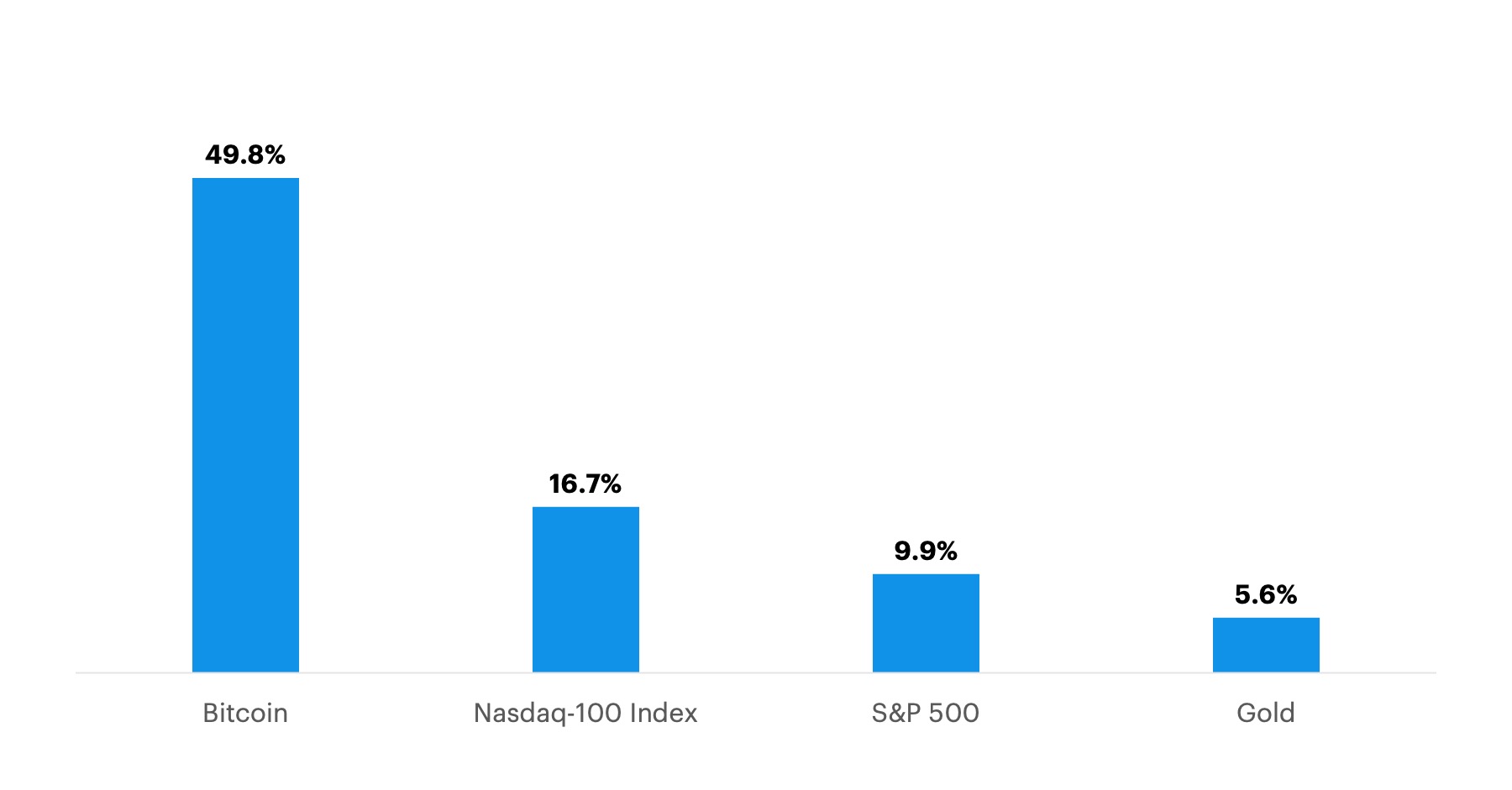

For starters, cryptocurrencies are not for everyone, and forecasting bitcoin’s price can be notoriously challenging, given its short history and high volatility. While it has shown an unusually high average annual return of 49% over the last 10 years, Morgan Stanley strategists believe this performance is unlikely to be repeated in the next decade.

Bitcoin Has Risen Much Faster Than Other Assets Over the Past 10 Years

Source: Bloomberg, Morgan Stanley Wealth Management Global Investment Office as of Dec. 31, 2023

Past performance does not guarantee future results. Investing in cryptocurrency is highly speculative and may result in a loss of the entire investment. An investment cannot be made directly in a market index.

Forecasting potential bitcoin returns

Instead of treating cryptocurrencies like stocks or bonds, which are often valued based on projected cash flows, it may be useful to look at crypto assets as commodities2, which are priced based on supply and demand.

Using this framework, investors may consider three factors:

- Supply is the easiest to forecast, as the software underlying bitcoin's network controls its growth. Today, the bitcoin money supply stands at 19.6 million and is set to grow to 20.7 million in the next 10 years. This supply limit is enforced by the governing algorithm and cannot change unless users agree.

Demand is the product of two assumptions: the addressable market and penetration.

- The addressable market refers to the amount of wealth that could potentially be stored in bitcoin. For simplicity, investors can focus on liquid assets that can quickly be converted to cash, such as checking accounts, savings accounts, and other short-term saving vehicles such as certificates of deposit—what’s known by economists as the “M2” money supply—as well as gold and bitcoin. Today, we see around $100 trillion stored globally in such assets, based on current prices.

- Penetration can refer to the percentage of overall wealth actually stored in bitcoin. Simply dividing bitcoin’s market capitalization by $100 trillion in wealth, as defined above, suggests it has a penetration of about 1%. Alternately, investors may define “penetration” as the percentage of investors with exposure to bitcoin in their portfolio.

Four potential scenarios for bitcoin’s long-term returns

Bitcoin supply growth has the least uncertainty and is expected to grow 0.6% a year for the next decade. For the growth of the addressable market, we combine near term M2 growth with the long term average M2 growth to arrive at a ten-year estimate of 6.3% a year. The last variable, penetration, is a wildcard and makes the most difference to long term returns.

Here are four illustrative examples, but everyone’s estimates are likely to differ substantially, and we do not favor any one estimate.

- More bearish: Some investments initially seem popular but then fall out of favor. Perhaps scaling methods fail or a competitor gains market share. Monthly bitcoin addresses peaked about three years ago, at 22 million, and have been declining at a 4.3% annualized rate. If the loss of users continues at a similar pace, shrinking with the historical adoption curve, it would suggest a 10-year annualized return of just 1.1%.

- Conservative: On the other hand, if the number of bitcoin investors remains flat (e.g., stable penetration) and current holders don’t increase their allocations, the price could still rise because overall wealth would be growing faster than bitcoin supply, implying a 10-year annualized return of 5.7%.

- Moderately aggressive: Alternately, you could assume bitcoin users will grow with the US population, and that younger people are more likely to adopt bitcoin than older ones. Also assume new users have a similar amount of wealth as existing users and new users choose to allocate the same percentage of wealth to bitcoin as the old. In this scenario, demand would rise by M2 growth, plus population growth, or 7.4%, suggesting a 10-year annualized bitcoin return of 6.2%.

- More aggressive: Bitcoin is becoming more popular and easier to buy, thanks to the new ETFs. Based on historical bitcoin adoption trends, if you assume that monthly active user growth moderates to 4.4% over the next four years and stays there for a decade, it would imply a 10-year annualized return of 10.4%.

Long-term return forecasts for bitcoin vary based on various penetration assumptions

| Penetration Assumption | Rationale | Penetration 10-Year CAGR (%) | Bitcoin Supply 10-Year CAGR (%) | M2 10-Year CAGR (%) | Annualized implied 10-Year Bitcoin Return (%) |

|---|---|---|---|---|---|

| Shrinks with historical adoption curve | Monthly addresses continue to decline at 2021-2023 annual rate | -4.3 | 0.6 | 6.3 | 1.1 |

| Stable penetration | No change in penetration | 0.0 | 0.6 | 6.3 | 5.7 |

| Grows with population | More popular with younger generation, may gain share as population grows | 0.5 | 0.6 | 6.3 | 6.2 |

| Grows with historical adoption curve | Previous adoption curve predicts future adoption | 4.4 | 0.6 | 6.3 | 10.4 |

Source: Glassnode, Morgan Stanley Wealth Management Global Investment Office as of Jan 30, 2024.

For illustrative purposes only. There is no guarantee that these estimates will come to pass. Investing in cryptocurrency is highly speculative and may result in a loss of the entire investment.

Investors can use this framework to explore what they think will happen to money supply, user growth and penetration — and plan accordingly.

Consider the risks

It’s important to note that these estimates are illustrative of the three-variable framework, and we do not endorse any of these assumptions.

Further, they do not factor in potential major risks, such as:

- broken encryption, which for example could make the system unusable,

- a software bug, which could increase supply, or

- adverse government action.

These are hard to quantify and thus suggest investors err on the side of conservatism in their other assumptions. While these scenarios may be off the mark, they can still be useful for planning purposes. Most importantly, investors can use this framework to explore what they think will happen to money supply, user growth and penetration — and plan accordingly.

Morgan Stanley’s Global Investment Office makes no recommendation regarding whether to buy or sell bitcoin but encourages investors to get educated. Ultimately, investing in bitcoin or any other cryptocurrency should be based on thorough research and understanding of the asset class. Investing in cryptocurrency is highly speculative and may result in a loss of the entire investment.

1 Generally, a store-of-value asset should be liquid, should not deteriorate with time and should hold its value over time. Many bitcoin holders believe it has these characteristics, while others disagree.

2 Although we are comparing bitcoin to commodities for the purpose of estimating returns, bitcoin has its own features and risks that are different than commodities. Specifically, bitcoin is a digital commodity subject to software and encryption risk which most other commodities do not have. Also, unlike most commodities it is not used up, it’s always available unless lost.

The source of this article, AlphaCurrents: Bitcoin: A Framework for Long-Term Return Assumptions, by Denny Galindo and James Ferraioli, was originally published on February 20, 2024.

CRC# 3885844 10/2024

How can E*TRADE from Morgan Stanley help?

Cryptocurrency

Cryptocurrencies are not offered directly via E*TRADE, but it is possible to gain indirect exposure to popular cryptocurrencies via securities and futures.

Choice Funds

Choose from a list of exchange-traded funds or mutual funds selected by Morgan Stanley Smith Barney LLC.