A guide to closed-end funds

E*TRADE from Morgan Stanley LLC in collaboration with Morgan Stanley Wealth Management

03/23/22Summary: Learn what closed-end funds are, how they compare to open-end funds, and considerations when investing in them.

Closed-end funds (CEFs) are actively managed, registered investment vehicles that pool the money of many investors to buy baskets of securities, providing access to equities, bonds, and other types of assets, depending on the strategy.

Many focus on producing income as a primary objective. They may appeal to investors who want diversification as well as the ability to tap into investment opportunities not available via open-end funds, such as mutual funds or exchange-traded funds (ETFs).

CEF characteristics

Source: Morgan Stanley Wealth Management CEF Research, as of 1/19/22

Closed-end funds vs. open-end funds

Mutual funds, for example, are “open” to new capital. They issue and redeem shares daily, typically at the end of the business day, based on the fund’s net asset value (NAV). The NAV represents the per-share value of a fund’s assets minus its liabilities. It tells investors how much one share of the fund is worth.

Closed-end funds, by contrast, are not continuously offered and have a fixed number of shares outstanding. There is a one-time initial public offering (IPO), and with limited exceptions, they are closed to new capital after the offering period (hence, “closed”). This gives CEFs a relatively stable asset base, which allows them to invest more of their assets without having to hold cash to meet redemptions.

After the IPO, CEF shares trade on the secondary market, where the price reflects current supply and demand. While shares of an open-end fund typically trade at or near its net asset value, a CEF's market price is typically at a discount to its NAV, which can be substantial (although premiums are possible). It’s important to note that the fund’s NAV can also decrease as a result of investment activities.

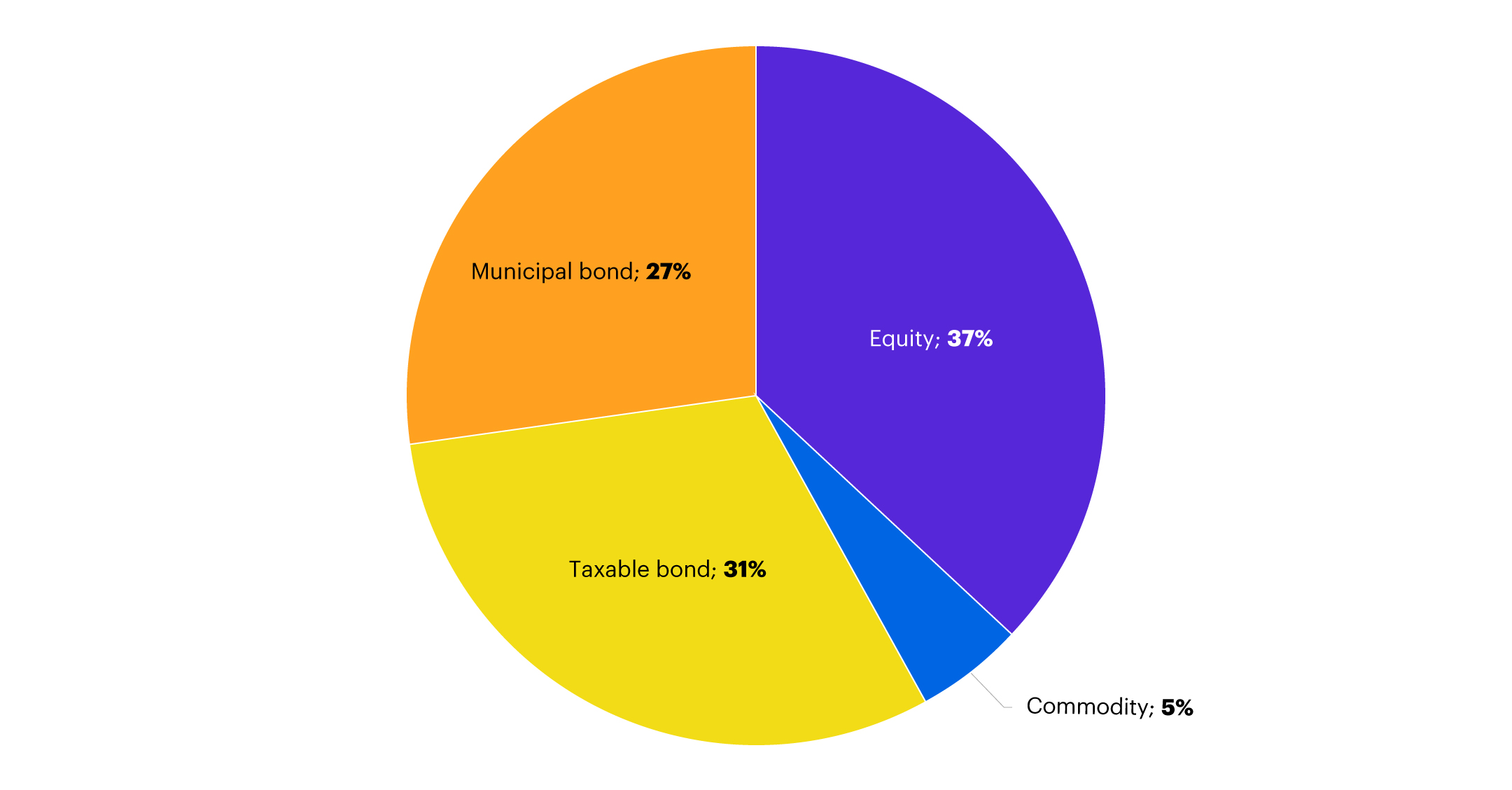

Types of closed-end funds

CEFs generally fall into one of the following categories:

- Equity funds invest in domestic and/or international stocks, often with a focus on a specific sector, style, or market cap.

- Tax-free fixed income funds invest in municipal bonds, often across states and sectors, providing monthly income that’s exempt from federal income taxes (sometimes state taxes as well).

- Taxable fixed income funds may invest in potentially higher-yielding asset classes, including those that individual investors might not otherwise have access to, such as floating rate loans, high-yield bonds, and emerging market debt.

CEF categories by market capitalization

Source: Bloomberg, Morningstar, Morgan Stanley Wealth Management CEF Research. Data as of 12/31/21. Category breakdown is percent of total market capitalization.

Weighing the pros and cons

There are benefits and drawbacks to investing in CEFs that investors should understand when deciding whether to add them to their portfolio.

Pros:

- Capability to leverage. Many CEFs use leverage in an attempt to enhance income and returns, but as noted below, leverage makes a fund riskier.

- Income distribution. Many CEFs, but not all, have an investment objective to distribute income on a monthly or quarterly basis. Distributions typically include interest income, dividends, capital gains, or a combination.

- Stable capital pool and access to less liquid investments. Since there are no daily inflows and outflows of capital, assets can be fully invested and more consistently dedicated to long-term investment strategies.

Cons:

- Volatility. While leverage can enhance returns, it can also increase losses and generally adds portfolio volatility.

- Possible changes in distribution levels. Dividend cuts can reduce an investor’s income stream and may lead to market price volatility.

- Potential underperformance. CEFs are actively managed by an investment manager and run the risk of underperforming market benchmarks and peers.

- Liquidity levels. Some CEFs do not trade frequently and there may be inconsistent liquidity among smaller funds, which generally will cause the market price of a CEF to fall. Additionally, CEFs generally do not usually redeem shares at NAV—investors must sell shares in the secondary market, which makes the following quite relevant.

- Increasing market discounts against NAV. The discount to NAV can widen and CEFs can be used for arbitrage, which can negatively impact retail investors. Since shares of CEFs frequently trade at prices below NAV, investors risk losing money when they sell shares purchased in an IPO.

Additional considerations

Beyond the pros and cons, investors considering adding a CEF to their portfolio should make sure they understand the fund's investment objectives, its risks, and its expense and redemption structure (if applicable). Depending on the CEF, there can be additional risks such as currency risks or sector-specific risks, for example. It's also important to evaluate a fund's total return, which takes into account changes in share price as well as income distributions.

The source of this article, “CEF Introduction & Applications,” was originally published on January 19, 2022.