How to build your investments into a portfolio

E*TRADE from Morgan Stanley

Summary: Being an investor means building and managing a portfolio, but it doesn’t have to be complicated. What you may want to consider before getting started.

What’s a portfolio?

Building and monitoring a portfolio is a foundational part of being an investor. Simply put, a portfolio is a basket of financial assets like stocks, bonds, and cash. In addition to your overall portfolios, you may have separate portfolios that serve various purposes. For example, a retirement portfolio, a trading portfolio, and a college fund portfolio.

Depending on where you are in your life, you may want your portfolio to grow in value or generate an income for you, but how do you decide which investments to include? This is where two closely related investing concepts may help: asset allocation and diversification.

Asset allocation: Your mix of investments

Your asset allocation is the mix of types of investments in your portfolio. Typically, investors talk about three main types of investments, or asset classes:

- Stocks, which are also called equities

- Bonds, also known as fixed income securities

- Cash and cash equivalents

For beginner investors, stocks, bonds, and cash are the main three on which you want to focus.

These different types of investments have different degrees of risk and different potential rewards. How you mix them determines your portfolio’s overall risk/reward balance, or your investment strategy. It could be:

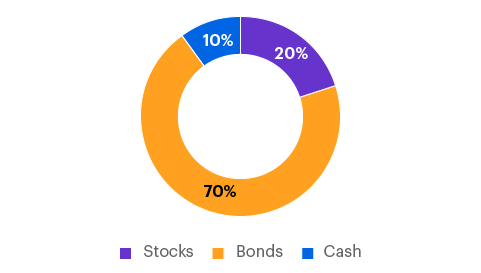

Conservative

This will typically mean a high percentage of cash and bonds in the portfolio, with the main goal of preserving existing wealth. This is a low risk approach because cash amounts don’t decrease, and while the value of a bond investment may change from day to day, you’ll generally get your original investment amount back, plus interest payments, if you hold a bond until it matures.

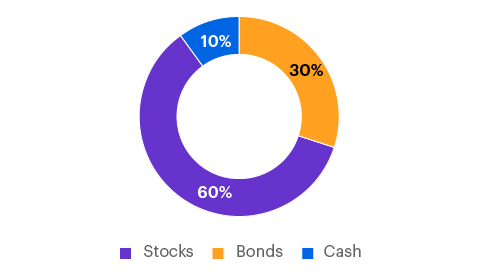

Moderate

This portfolio will typically have more stocks than the conservative approach and aim for some growth with moderate risk.

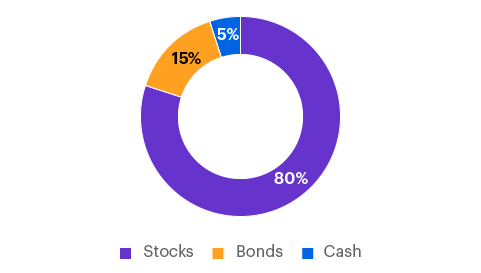

Aggressive

An aggressive portfolio will generally have a high percentage of stocks and a smaller proportion of cash and bonds. The stocks provide a greater potential to make profits, but also greater risk and potential for losses.

Diversification

Diversification means putting your money in a variety of different investments to manage or potentially reduce your risk. Once you’ve settled on the appropriate asset allocation for you, consider diversifying your holdings within each asset class. Instead of buying stock in only one company or one industry, for example, you could purchase stocks in many companies of different sizes, in different industries, or different locations. Within your bond portfolio, you might include bonds from different companies and with different durations, or length to maturity.

This may reduce risk because when you have a diversified portfolio—that is, you’ve spread your eggs among many baskets—it’s not as vulnerable to taking a big hit if things go wrong for a single company or industry.

So how do you go about building a diversified portfolio? One way is to invest in exchange-traded funds (ETFs) and mutual funds, which provide access to hundreds or thousands of stocks and bonds and invest broadly in the markets. Here are three simple ways to find and invest in ETFs and mutual funds:

Diversification means putting your money in a variety of different investments to manage or potentially reduce your risk.

- E*TRADE from Morgan Stanley screeners. We have a range of screeners and other research tools to help you discover the ETFs and mutual funds that are right for you. Look for screeners that might make sense for you on our thematic investing page.

- Prebuilt portfolios. These are E*TRADE educational tools that ask you to choose your investment strategy—conservative, moderate, or aggressive—and then show you selections of ETFs or mutual funds that you can purchase to build your portfolio.

- Core Portfolios. This option provides easy, automated ETF investing backed by the E*TRADE from Morgan Stanley investment strategy team. You answer questions about your risk tolerance, goals, and timeframe, and we build your portfolio and manage your investments day-to-day for a fee.

Managing your portfolio

Once you’ve built a diversified portfolio that fits your goals, you’ll need to keep up on a few tasks from time to time in order to stay on track with your financial goals:

- Check performance. Every so often, check to see how your investments are doing. How are they performing compared to the broader markets? While most long-term investors don’t want to make changes based on one day’s news or events, consider monitoring them and how they relate to your timeline and financial goals.

- Stay informed. Keep an eye on news and events related to companies and industries in which you’re invested. Are there trends or possible future developments that could affect your investments?

- Monitor your asset allocation. Once or twice a year, take a close look at your investment mix to make sure it’s still aligned with your investment goals and risk tolerance. E*TRADE provides tools to help you analyze your portfolio and asset allocation.

- Rebalance. As some of your investments rise in value, and others fall, the balance in your portfolio can drift away from your original target, especially during times of market volatility. You may need to periodically rebalance it to ensure your mix of assets stays where you want it to.

- Adjust to life stages. Over time, your appetite for risk may change. For example, it’s common for people nearing retirement to try to reduce risk and preserve their savings. Other life stages like having children, getting a raise, or changing jobs can also impact your investing goals.

Understanding these basic principles is the first step in building an investment portfolio. Explore E*TRADE's Knowledge Library for much more on portfolios, asset allocation, ETFs, mutual funds, and other investing and trading topics.

CRC# 3669410 07/2024

How can E*TRADE from Morgan Stanley help?

Prebuilt Portfolios

Select your risk tolerance and easily invest in diversified, professionally selected portfolios of mutual funds or exchange-traded funds (ETFs). And you pay no trading commissions although fund fees and expenses still apply.

Get started with as little as $500 (mutual funds) or $2,500 (ETFs).

Bonds

Gain direct access to more than 50,000 bonds and fixed income products from issuers of every kind.

Core Portfolios

With Core Portfolios, we'll build, manage, and rebalance a diversified ETF portfolio for you. And we can help you invest in socially responsible companies too.

Risk Assessment Tool

How risky is your portfolio?

Understanding risk is key to managing your investment performance. See your portfolio’s volatility, asset allocation and how you might fare in different hypothetical market scenarios.