What is a dividend?

E*TRADE from Morgan Stanley

Summary: Investors can potentially use dividends to supplement their income. But what are dividends? Learn what they are, and how you can possibly use them to maximize your investing.

Investors seeking income are often drawn to purchasing stocks that pay dividends. In fact, some investors may be more interested in the regular dividend payment than in the growth of the stock's price, or they may be looking to combine the benefits of regular income with the potential for stock price appreciation.

Before you start investing for dividends, here’s what you should know:

What is a dividend?

A dividend is a payment that a company makes to its stockholders from its profits. Dividends are typically paid regularly and made as a fixed amount per share of stock. The more shares you own, the larger the total dividend payment you’ll receive.

There are three main types of dividends:

- Cash dividends are the most common type of dividend and are often paid quarterly, but sometimes semi-annually or annually.

- Stock dividends are from companies that want to conserve their cash. Therefore, they pay dividends in the form of additional shares of stock.

- Special dividends are an extra dividend of additional cash or stock beyond a company’s current or regular dividend. A company may pay a special dividend when they have an unusually profitable quarter or year.

Other types of dividends that are not as common include:

- Hybrid dividends are a combination of cash and stock.

- Property dividends are physical assets that a company may have in excess inventory. They typically have a monetary value and are used to distribute to shareholders in lieu of cash or stock.

How do you earn dividends?

Once you purchase stock, in order to receive a dividend, you have to be a registered shareholder. In most countries, including the US, registration is automatic and requires no special action when you buy a stock.

Owners of both common and preferred shares may receive a dividend, but the dividend for preferred shares of a stock may be significantly higher.

Here are important stock dates you need to know:

1. Declaration date

The date a company announces its intention to pay a dividend.

2. Record date

The date you must be registered by to receive the paid dividend.

3. Ex-dividend date

The date you can no longer buy shares and receive the last declared dividend.

4. Payment date

The date on which the dividend is actually paid to its registered stock owners.

It’s important to pay attention to the stock dates because once a company declares that it will pay a dividend, it will confirm the record date. Subsequently, the record date will determine the ex-dividend date. If you buy a stock on or after the ex-dividend date, you will not receive the most recently declared dividend. You're essentially buying the stock ex, or without, the dividend. To compensate buyers for this, on the ex-dividend date, the share price typically will be reduced by the amount of the dividend.

In the US, as of January 2025, the ex-dividend date is the same day as the record date or one business day before if the record date is not a business day.

If you’re selling a stock but want to receive the dividend, you must wait until the ex-dividend date to sell your shares. If you sell before the ex-dividend date, you’re also selling the right to receive the dividend.

Dividend payments are usually deposited directly into your brokerage account. Otherwise, a check in the amount of the dividend payment is mailed to you on the payment date.

Why are dividends important to investors?

Dividends are a component of an investor's total return, especially for investors with a buy-and-hold strategy. With some stocks, dividends may account for a substantial percentage or even a majority of total returns over a given time period.

Dividends also provide:

- Steady income: Investors can earn steady income from their investments, which can also cushion the blow if a stock's price drops.

- Reinvesting opportunity: When interest rates are low, investors may re-allocate their funds from interest-bearing assets into more productive dividend-paying stocks.

- Clues about the company:

- Positive: Paying dividends is generally considered a sign of a healthy, established company with a favorable financial future and profit potential.

- Neutral: Paying dividends may mean that a company has relatively modest growth prospects—it can be seen as evidence that the company can't find a more productive use for its profits. This is why young, fast-growing companies typically do not pay dividends.

- Negative: On the other hand, when a company that has been regularly paying dividends cuts the dividend, this could also be an important signal of financial trouble.

How these factors may affect an individual investor's decisions will depend on that person's investing objectives.

How are dividend returns determined?

Dividend yield1 is the yearly income an investor receives in dividends expressed as a percentage of the stock's price. It's an easy way to compare the dividend amounts paid by different stocks.

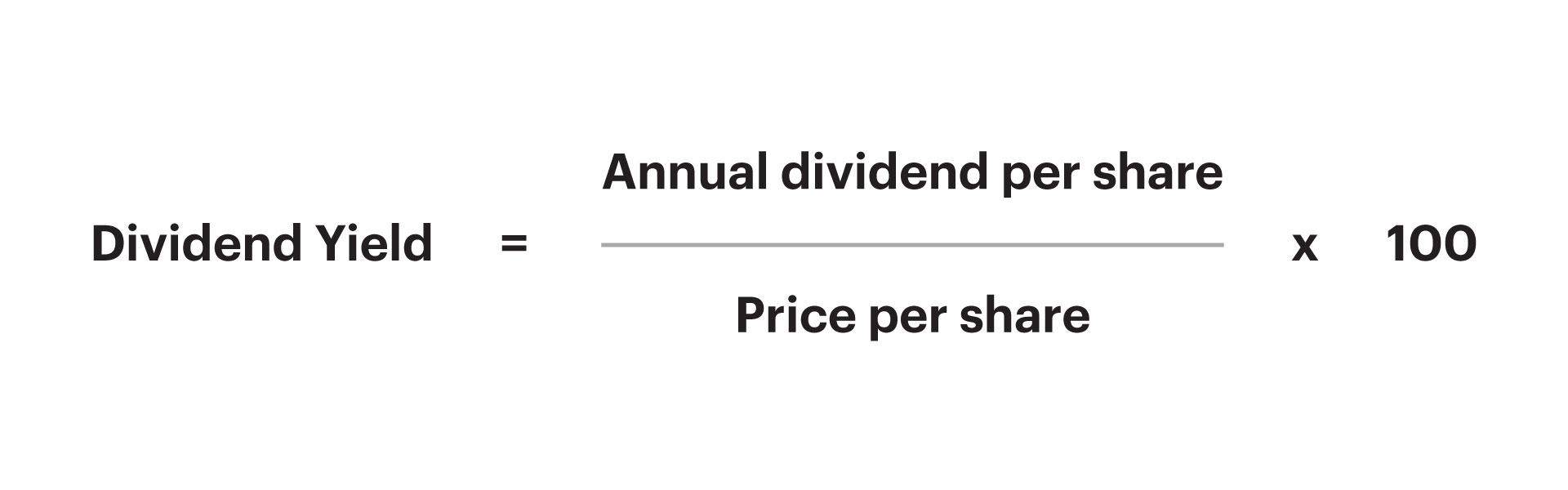

To calculate dividend yield, divide the annual dividend per share by the price per share, then convert the result to a percentage.

Dividend yield should never be the only factor an investor considers when deciding whether to buy a stock. However, income-focused investors tend to prefer higher dividend yields if all else is equal.

Many income-oriented investors also look for a consistent history of dividend payments, preferring companies whose dividend payments have grown over time (or at least remained steady), with no missed quarters.

What is a dividend payout ratio?

The dividend payout ratio tells you how much of a company's yearly profits is paid out in dividends to its shareholders. It can be calculated for the entire company or per share.

Many investors use the dividend payout ratio as an indicator of a company's financial health. If a company is able to continue paying dividends at its current or consistent rate, it’s a sign of safety and stability. A payout ratio above 100% would mean that a company is paying more in dividends than it is earning, which is unsustainable long-term.

Dividend payout ratios will vary widely based on several factors.

- Young, growth-oriented companies may have a zero, or very low payout ratio, while more established companies will often have higher payout ratios.

- There are also differences between industries and sectors, so this ratio is most useful when comparing companies within a specific industry.

Should dividends be reinvested?

You can use dividends to:

- Subsidize expenses

- Accumulate as cash in your brokerage account

- Automatically buy additional shares

Buying additional shares is often referred to as a Dividend Reinvestment Program or "DRIP". DRIPs offer several significant advantages for investors, including:

- Convenience: DRIPS may help you automatically build out a more sizable position in a security over time. New shares are purchased on the dividend payment date, using the proceeds from the dividend.

- Cost-effectiveness: In most cases, DRIP purchases are free from commissions and other fees, making them a low-cost option for growing your investments.

Know that dividend payments aren’t always guaranteed. And, because dividends are considered income, they generate a tax liability, regardless of whether the dividends are spent, saved, or reinvested.

How can E*TRADE help?

Brokerage account

Investing and trading account

Buy and sell stocks, ETFs, mutual funds, options, bonds, and more.

Dividend dominant

Potentially add to your income stream by investing in companies that have historically paid dividends.

Prebuilt Portfolios

Select your risk tolerance and easily invest in diversified, professionally selected portfolios of mutual funds or exchange-traded funds (ETFs). And you pay no trading commissions although fund fees and expenses still apply.

Get started with as little as $500 (mutual funds) or $2,500 (ETFs).

Premium Savings Account

Boost your savings with Annual Percentage Yield2

With rates 8X the national average3 and FDIC-insured up to $500,0004; certain conditions must be satisfied.

Morgan Stanley Private Bank, Member FDIC.