Gauging a potential breakout

- WTW in tight, one-month trading range

- IV above average while HV is at three-year low

- Earnings scheduled for late April

While out-of-the-ordinary price action in a stock usually results in unusual options activity, the reverse isn’t necessarily true.

On Wednesday, for example, Willis Towers Watson (WTW) appeared on the LiveAction scan for high call-put ratios while its stock was the definition of “nothing much to see here:” With volume of less than 100,000 shares around midday, shares spent most of the morning a little above breakeven.

And while WTW is near its all-time highs and has enjoyed a nearly 35% rally off its late-October lows, the following chart shows it’s been enjoying that same gain for nearly a month:

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

The stock has formed an increasingly narrow trading range since February 28, never closing lower than $271.18 or higher than $274.90. On Wednesday, WTW’s 30-day historical volatility (HV) was at its lowest level since January 2022 (bottom, blue line).

Tight ranges like this often attract traders looking to capitalize on potential breakouts. The logic is that bulls and bears continue to enter the market during the consolidation, and when prices eventually push out of it, traders caught leaning the wrong way have to scramble to get out of their positions, throwing extra fuel on the momentum fire.

Well enough, but aside from the difficulty of knowing when a breakout will occur, there’s also the challenge of correctly forecasting its direction. That’s why some traders think about using non-directional options spreads like strangles and straddles. After all, if you expect a dormant stock to make a move—that is, you expect its volatility to increase—it would seem to make sense to use a strategy that can profit regardless of whether that move is up or down.

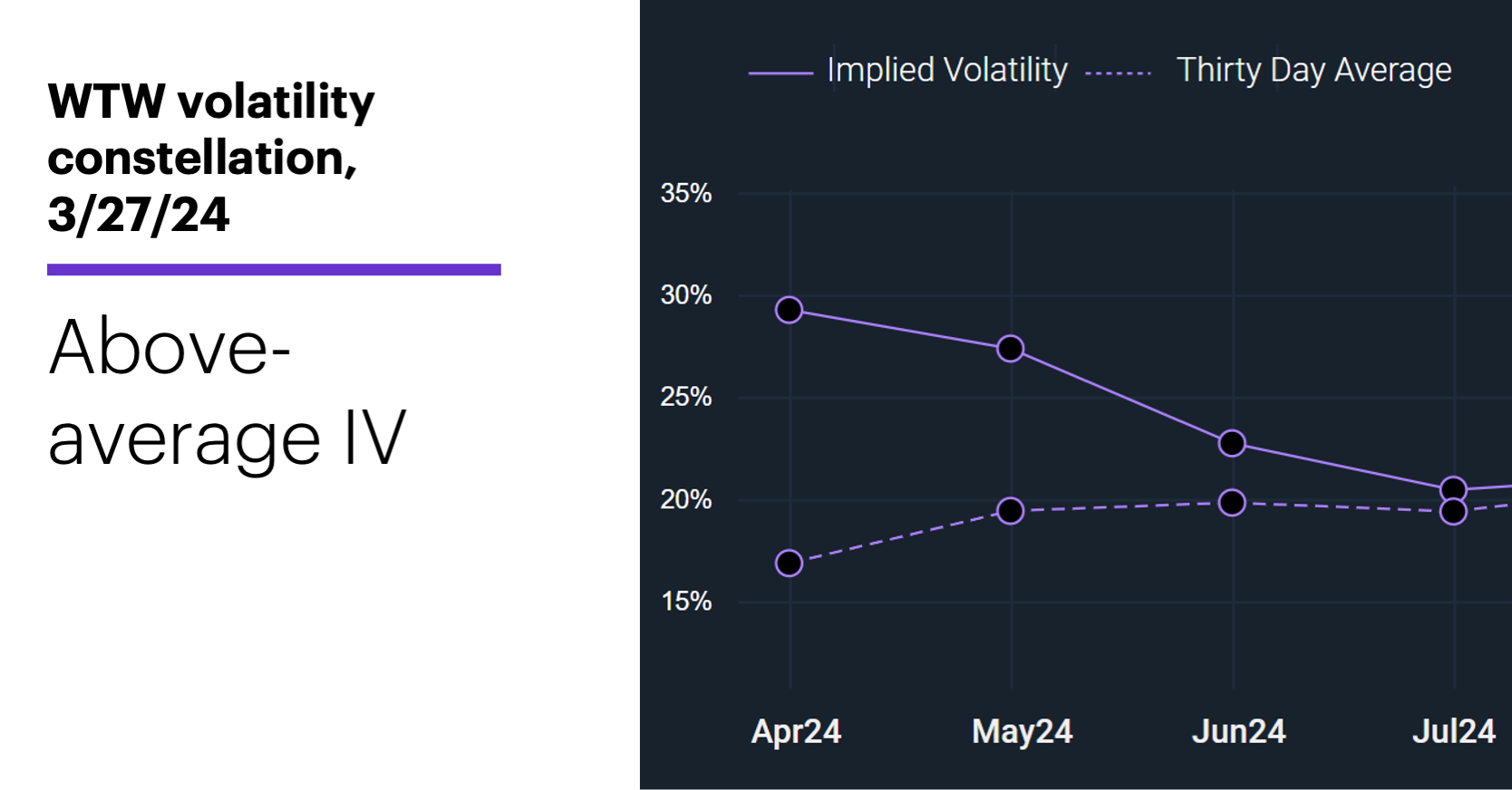

But as the bottom of the previous chart showed, WTW’s options implied volatility (IV) was more than twice as high as its HV—meaning, the options market was expecting more volatility over the next 30 days than had occurred over the previous 30. Also, WTW’s volatility constellation shows WTW’s IV was significantly above average for the next two expirations (April and May):

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

That relatively high IV means long strangle and straddle traders could be paying elevated prices for their options, and that can make it much more difficult for these positions to turn a profit.

WTW is currently scheduled to release earnings in late April. For the sake of argument, let’s say a trader expects the announcement to break the stock out of its range, one way or the other. The April options expire before earnings are released, so the trader decides to buy a May $270 straddle (long the May $270 call and $270 put), which on Wednesday was trading around 18.00 ($1,800). That means, at expiration, the stock would have to be trading below $252 ($270-$18) or above $288 ($270+18) to generate any profit.

Bottom line, there’s more to trading than a correct forecast. It also requires knowing the advantages and disadvantages of different types of strategies.

Market Mover Update: It’s a holiday-shortened week—markets will be closed for Good Friday. And even though Easter weekend moves around on the calendar, there have been a couple of interesting “seasonal” tendencies surrounding it. On average, the S&P 500’s (SPX) strongest day the week before Easter was Thursday (today), which was up 67% of the time. The Monday after Easter was a down day 55% of the time.1

Today’s numbers include (all times ET): Q1 GDP, final estimate (8:30 a.m.), weekly jobless claims (8:30 a.m.), Chicago PMI (9:45 a.m.), consumer sentiment (10 a.m.), Pending Home Sales Index (10 a.m.), EIA Natural Gas Report (10:30 a.m.).

Today’s earnings include: MSC Industrial Direct (MSM), Walgreen's (WBA), Semtech (SMTC).

Click here to log on to your account or learn more about E*TRADE's trading platforms, or follow the Company on X (formerly Twitter), @ETRADE, for useful trading and investing insights.

1 Figures reflecting S&P 500 (SPX) daily closing prices, 1957-2023. Supporting document available upon request.