Chilly start to 2024

- Stocks and bonds both fall to start New Year

- Tech and small caps out, utilities and health care in

- This week: Inflation (CPI and PPI), earnings season starts

Four trading days doesn’t make a year, but the first week of 2024 saw the stock market turn 2023’s “risk-on” script on its head. Stocks were down, bond yields were up, and traders pivoted away from tech and into defensive sectors like utilities and health care.

And the SPX’s run of positive weeks ended at nine. After losing ground the first three days of the year and falling to its lowest level in more than three weeks, the S&P 500 (SPX) bounced Friday in the wake of the latest jobs report—but not nearly enough to avoid its first weekly loss since October 27:

Source: Power E*TRADE. (For illustrative purposes. Not a recommendation. Note: It is not possible to invest in an index.)

The headline: S&P 500 snaps streak to start New Year.

The fine print: Last week’s solitary up day followed Friday morning’s stronger-than-expected jobs report. A still-robust labor market may cast some doubt on how quickly the Fed will cut rates this year, and any hotter-than-expected inflation data could compound the uncertainty. As Morgan Stanley & Co. economists note, those looking for a March rate cut may have to be a little more patient.1

The number: 9. This year will go down in the books as just the ninth time since 1957 that the SPX started a year with three down days.

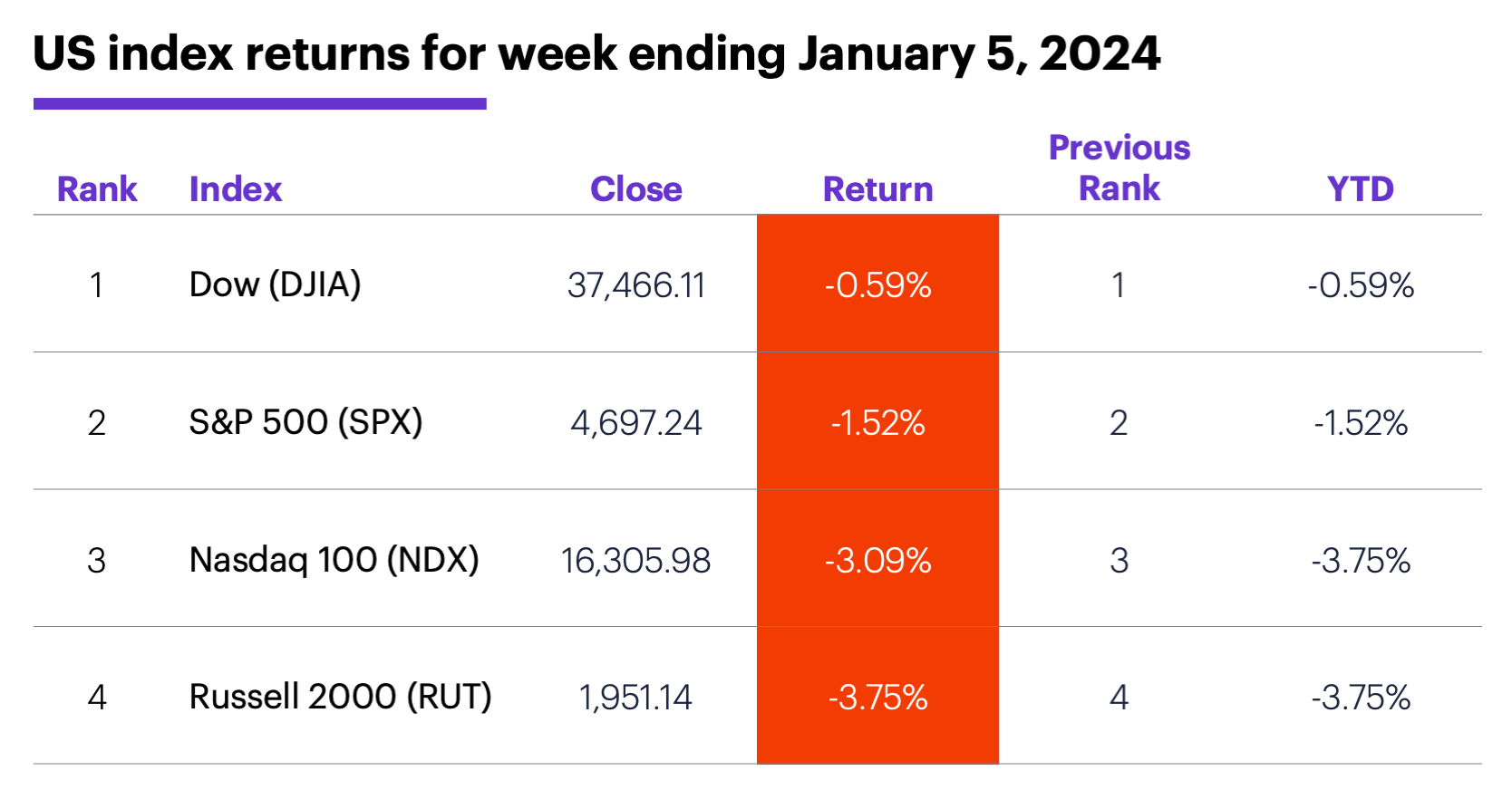

The scorecard: The small-cap Russell 2000 (RUT) took the biggest step back:

Source (data): Power E*TRADE. (For illustrative purposes. Not a recommendation.)

Sector returns: The strongest S&P 500 sectors were health care (+2.1%), utilities (+2%), and Energy (+1.1%). The weakest sectors were tech (-4.2%), consumer discretionary (-3.6%), and real estate (-2.3%).

Stock movers: Curis (CRIS) +6% to $14.47 on Wednesday, Dyne Therapeutics (DYN) +31% to $19.39 on Thursday. On the downside, Corcept Therapeutics (CORT) -26% to $24.16 on Tuesday, Mobileye Global (MBLY) -25% to $29.97 on Thursday.

Futures: After falling to a nearly three-week intraday low of $69.28 last Wednesday, February WTI crude oil (CLG4) rallied to end the week with a gain at $73.92. February gold (GCG4) posted a modest loss in the first week of the year, closing Friday at $2,051.80.

Coming this week

This week features the first inflation numbers of the New Year:

●Monday: Consumer Inflation Expectations, Consumer Credit Change

●Tuesday: NFIB Business Optimism Index, Trade Balance

●Wednesday: Wholesale Inventories

●Thursday: Consumer Price Index (CPI)

●Friday: Producer Price Index (PPI), Quarterly Grain Stocks (corn, wheat, soybeans)

Earnings season kicks off with big banks on Friday:

●Monday: Helen of Troy (HELE), Commercial Metals (CMC)

●Tuesday: Acuity Brands (AYI), PriceSmart (PSMT), Smart Global (SGH), WD-40 (WDFC)

●Wednesday: KB Home (KBH)

●Thursday: Bank of South Carolina (BKSC)

●Friday: Bank of America (BAC), Bank New York Mellon (BK), Blackrock (BLK), Citigroup (C), Delta Air Lines (DAL), JPMorgan Chase (JPM), UnitedHealth (UNH), Wells Fargo (WFC)

Check the Active Trader Commentary each morning for an updated list of earnings announcements, IPOs, economic reports, and other market events.

Initial readings

While any discussion about the “significance” of the first four trading days of the year is premature, today may offer some insight into whether January will be a positive or negative month for stocks.

As discussed here last week, the SPX’s direction in the first five trading days of the year has been a better-than-average indicator of January’s overall direction. Since 1957, when the SPX gained ground over the first five days, January was an up month 73% of the time, but when it lost ground in the first five days, January was a down month 70% of the time. The SPX will have to rally at least 1.6% today (close above 4,769.83) to have a positive return for the first five trading days of 2024.

And while it’s impossible to read much into just eight examples, the SPX’s behavior after the other times it started a year with three down days showed an interesting split. Twenty-one trading days later (roughly one month), the SPX was higher four times and lower the other four. But the moves were larger than average in both cases: When the SPX was higher, its median gain was 3.8%, and when it was lower, its median loss was -3.4%. Since 1957, the SPX’s median 21-day gain is around 2.7%, and its median 21-day loss is around 2.5%.2

Click here to log on to your account or learn more about E*TRADE's trading platforms, or follow the Company on Twitter, @ETRADE, for useful trading and investing insights.

1 MorganStanley.com. Don’t Count on a March Rate Cut. 1/3/23.

2 Reflects S&P 500 (SPX) daily closing prices, 12/30/56–8/22/23. Supporting document available upon request.