The news before the news

- KURA rallied nearly 60% intraday on Wednesday

- Key clinical results not due until next week

- Options implied volatility near multi year highs

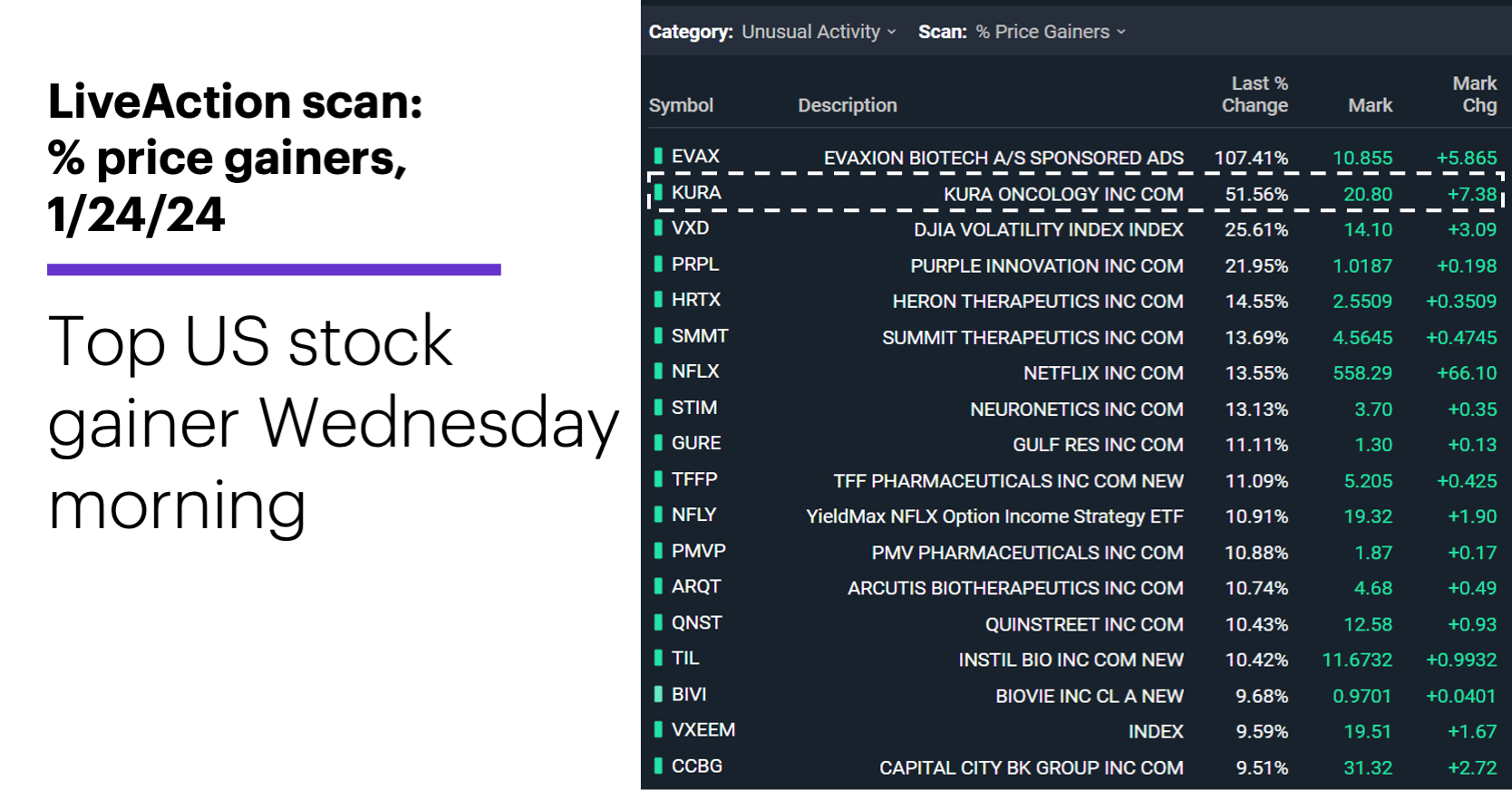

We’re approaching the height of earnings season, and that means companies releasing their numbers will be increasingly prevalent on LiveAction scans. Netflix (NFLX), for example, made its presence felt on several scans Wednesday, including the one for largest percentage gains.

But NFLX was far behind another stock that hadn’t released earnings—Kura Oncology (KURA), which in early trading was up more than any other US stock, and more than any stock that entered the day trading above $10/share:

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

Although Kura, a biotech company specializing in cancer treatments, isn’t scheduled to release its numbers until February 22, it does have another important event on the near-term horizon—one that was, possibly, connected to an interesting news story on Wednesday.

The stock’s nearly 60% intraday rally unfolded amid reports the company had received a $150 million investment—a cash infusion that precedes KURA’s scheduled (pre-market) announcement on Tuesday, January 30 about the clinical test results for a leukemia drug. The move pushed KURA to its highest high ($21.40) since July 2021, just three months after it hit its lowest low ($7.41) in nearly four years:

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

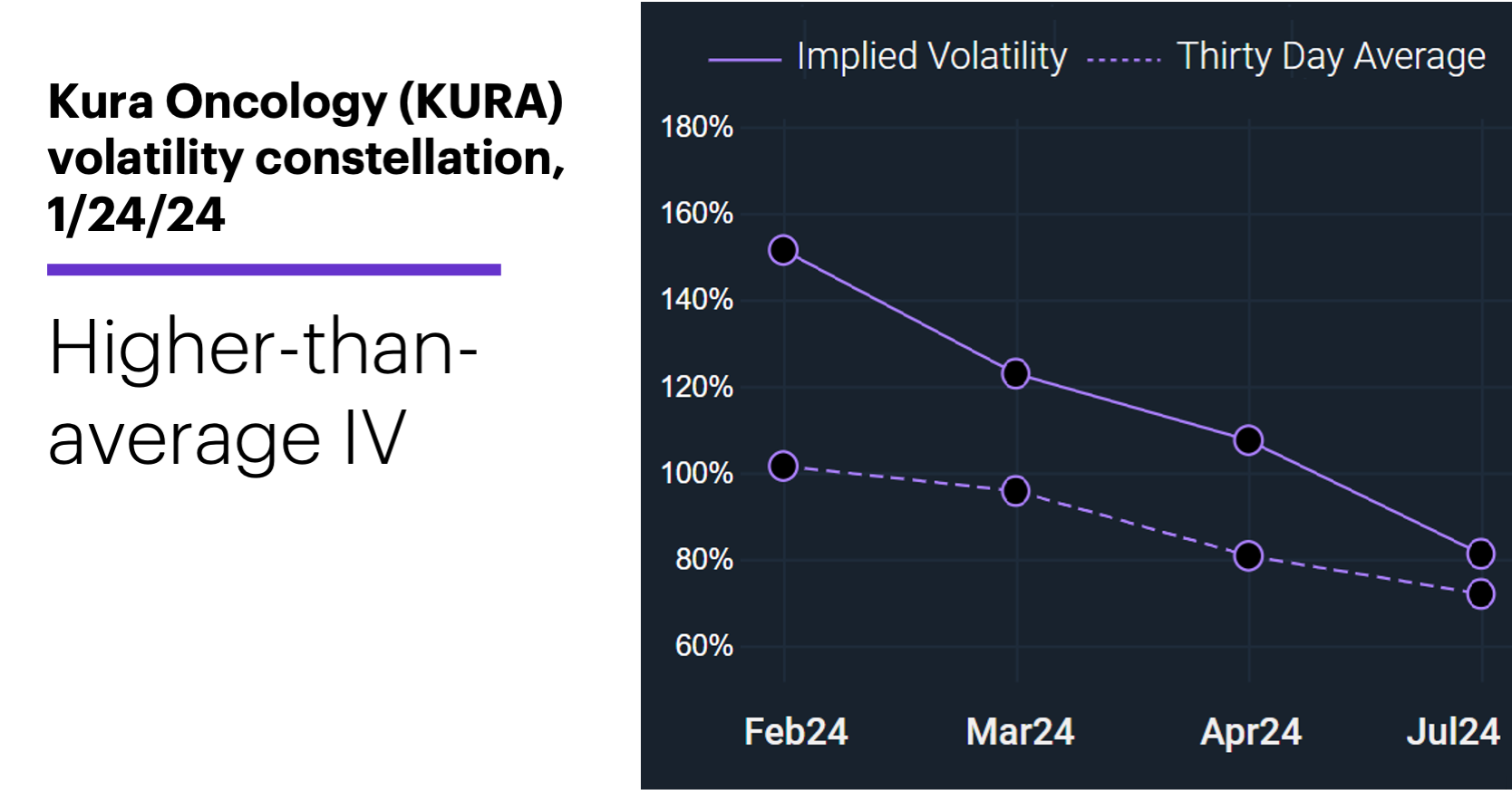

Meanwhile, options implied volatility (IV) is near its highest level of the past six months—well above the 30-day average for the next few expirations:

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

A key takeaway is that traders who saw yesterday’s investment news as a possible vote of confidence in KURA’s test results next week—and there’s no way to know if it is—are nonetheless looking at options prices that are potentially overinflated because of their high IV.

In other words, even if the stock moves in the expected direction or by the expected amount, traders who buy options with higher-than-average IV may find their positions don’t appreciate as much as they’d hoped. After news hits the Street, uncertainty is gone, and IV often evaporates along with it—deflating options prices just as it inflated them before.

Being consistently right about the direction of a stock or its volatility is difficult enough. But traders can make things less challenging by knowing when underlying market conditions are working against a certain type of strategy.

Today’s numbers include (all times ET): Durable Goods Orders (8:30 a.m.), GDP (8:30 a.m.), advance International Trade in Goods (8:30 a.m.), Weekly Jobless Claims (8:30 a.m.), Chicago Fed National Activity Index (8:30 a.m.), advance Retail and Wholesale Inventories (8:30 a.m.), New Home Sales (10 a.m.), EIA Natural Gas Report (10:30 a.m.).

Today’s earnings include: American Airlines (AAL), Archer Daniels Midland (ADM), Eagle Materials (EXP), Southwest Airlines (LUV), Northrop Grumman (NOC), Intel (INTC), Levi Strauss (LEVI), T-Mobile (TMUS), Visa (V).

Click here to log on to your account or learn more about E*TRADE's trading platforms, or follow the Company on Twitter, @ETRADE, for useful trading and investing insights.

1 Investor’s Business Daily. Kura Oncology Rockets 39% Before Unveiling Cancer Drug Test Results — Here's Why. 1/24/24.