How to avoid the top 5 mistakes investors make in a market sell-off

Morgan Stanley Wealth Management

06/25/25Summary: Learn how to spot—and potentially avoid—common mistakes that some investors make in a market sell-off.

There’s no doubt about it: market sell-offs are unsettling. Seeing your account value decline can cause even level-headed investors to second guess their strategy. The fact is periods of volatility are not uncommon.

During these times, it’s important to recognize common investing mistakes—and know what to do instead.

1. Panic selling

It can be gut-wrenching to see your investment portfolio or the 401(k) plan that you’ve been building for years take a sudden dive. The urge to cut your losses and wait for the dust to settle can be overwhelming. Ironically, this can be the single most damaging thing an investor can do.

Selling into a falling market ensures that you lock in your losses. If you wait years to get back in, it can be hard to fully recover.

Consider that someone who stayed invested from 1980 until the end of March 2024 would have a 12% annual return, whereas someone who started at the same time, but sold after downturns and stayed out of the market until two consecutive years of positive returns, would have averaged a 10% return annually. (Past performance is not indicative of future results. Actual results may vary).

That may not sound like a huge difference, but if each investor contributed $5,000 a year, the buy-and-hold investor would have $5.3 million now; the waffler would have $3.1 million.

- Instead, try this: Take the long view. If you don’t need cash right away and have a well-diversified portfolio, realize that downturns ultimately tend to be temporary. The market may sometimes feel like it could go to zero, but history has shown that rebounds can return many portfolios to the black in due time.1

2. Moving to cash and staying there

This mistake compounds the damage from panic selling. The strong rebound in stock prices that often follows a market downturn should underscore how bailing out can cost you when the market reverses direction.

Returning to our hypothetical example, an investor who sold after a 30% market drop and stayed in cash would have just $497,000 after more than 44 years, even after investing $5,000 a year.

- Instead, try this: Investors who have more cash than their long-term strategy calls for because they sold during the market slide, or for any other reason, may want to look to close that gap and get invested. Dollar-cost averaging, a method of automatically investing the same amount at regular intervals (say, monthly) to get back into the market gradually, can be a good way to get there.

Dollar-cost averaging potentially reduces the sensitivity of your portfolio. This can make it easier for anxious investors to avoid the worry of putting a big chunk of money into the market, only to have the sell-off resume. If the market rebounds, they will be glad that they already put some of their money back to work, rather than having all of it on the sidelines.

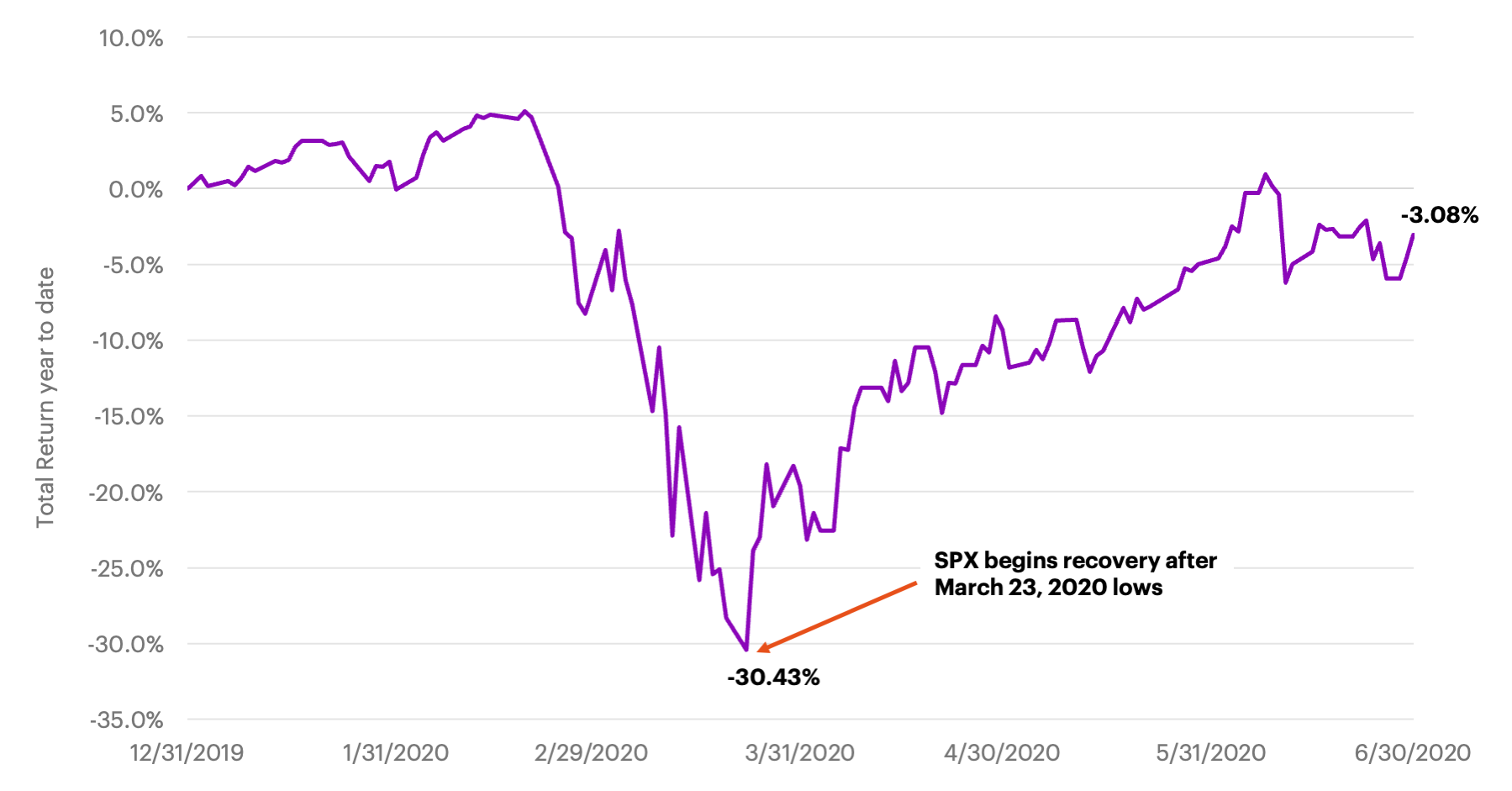

S&P 500 (SPX): 1/1/20–6/30/20

Source: FactSet Research Systems. Past performance is no guarantee of future results. An investment cannot be made directly in a market index.

3. Feeling overconfident and making poor choices

Many people tend to overestimate their ability to judge when an investment is a great deal at a certain price. They might compare the price of a stock that’s been beaten down and consider it an opportune time to buy—while it still may have a lot further to fall.

But stocks that undergo wrenching losses often do so for fundamental reasons, and the possible outcomes of this strategy could end with a portfolio in disarray and even deeper losses. This practice of buying into a down-trending market and profiting from short-term trading is a lot more difficult in practice than it seems.

- Instead, try this: Know that, in times of market uncertainty, you don’t have to go it alone. E*TRADE from Morgan Stanley has educational resources plus thought leadership and commentary on the latest market happenings. Or consider talking to a professional who can help you understand how to proceed, based on your time horizon and risk tolerance.

4. Holding on to losers

Most people don’t like selling investments at a loss. This can cause them to hang on to losers too long believing those stocks will rise again, and to sell winners too early worrying those stocks will decline. Often, investors would be better off selling stocks doing poorly in the market and holding onto stocks that are rising because they are better positioned for the current environment.

- Instead, try this: Proactively take advantage of current opportunities, which can often run counter to those instincts. Consider tax-loss harvesting. For example, if losses arise in a taxable investment account, “harvesting” them by selling those positions can improve long-term tax efficiency. Also, some investors may be better off converting at least some of their retirement savings from a Traditional IRA to a Roth IRA if eligible. Since there are tax consequences, doing a conversion when stock values are depressed may potentially increase tax benefits over the long-term.

Most people don’t like selling investments at a loss. This can cause them to hang onto losers too long believing those stocks will rise again, and to sell winners too early worrying those stocks will decline.

5. Forgetting to rebalance

During a major market selloff, a portfolio’s asset allocation to equities tends to decrease substantially, as stocks sell off and bonds rally. Forgetting to rebalance back into equities may extend the amount of time a portfolio takes to recover from a market downturn.

- Instead, try this: If you’ve decided on a rebalancing plan, stick to it. Some studies have shown that rebalancing tends to improve risk-adjusted returns over time (as long as it doesn’t generate excessive tax and transaction costs) by reducing portfolio sensitivity to the timing of up and down markets.1

The consequence to buying equities to rebalance after a selloff is the need to sell them after a strong bull market moves those allocations much higher. That tends to enforce a buy-low and sell-high discipline on your investments that is systematic, rather than speculative.

Another Mistake (honorable mention): Not having a financial plan

Each of these five mistakes have one thing in common: They involve investors reacting to market events. But being reactive can be costly. Take the 2020 COVID market crash as an example. The S&P 500 Index fell by 34% in just over a month. If you sold along with the crowd, it’s likely that your portfolio would have been severely compromised.

- Instead, do this: Create a thoughtful financial plan that can serve as your “north star,” helping you to avoid rash decisions in times of market stress and to focus on what really matters: staying on track toward your long-term goals.

What’s more, if you are at risk of falling off track, small changes to your financial plan—such as modestly increasing your savings rate, slightly reducing your spending and/or waiting a little longer for your goal—can help you get back on track, without resorting to selling assets in a down market.

There’s no question that investment losses are painful, but if investors can stay focused on their goals, rather than fixating on daily market noise—you may likely be better off in the long run.

Planning for your future is one of the most important steps you can take to help alleviate uncertainty. E*TRADE’s planning experience (login required) puts key tools and resources at your fingertips to help you take control of your financial future.

Tools like E*TRADE’s Portfolio Analyzer (login required) can also help investors take a deep dive into their asset allocation to make sure their portfolio is still mapped to their goals, risk tolerance, and time horizon.

Article Footnotes

1 Morgan Stanley Wealth Management Global Investment Office, December 2023.

The source of this Morgan Stanley article, Top 5 Mistakes Investors Make in Volatile Markets, was originally published on May 24, 2024.

CRC# 4606099 06/2025

How can E*TRADE from Morgan Stanley help?

Core Portfolios

With Core Portfolios, we'll build, manage, and rebalance a diversified ETF portfolio for you. And we can help you invest in socially responsible companies too.

Automatic investing

Looking to build good financial habits? Consider setting up recurring investments in a retirement or brokerage account.

Premium Savings Account

Boost your savings with 3.75% Annual Percentage Yield for 6 months1

With rates 9X the national average2 and FDIC-insured up to $500,0003; certain conditions must be satisfied.

Morgan Stanley Private Bank, Member FDIC.

Risk Assessment Tool

How risky is your portfolio?

Understanding risk is key to managing your investment performance. See your portfolio’s volatility, asset allocation and how you might fare in different hypothetical market scenarios.