Two tax-aware strategies investors should know about

E*TRADE from Morgan Stanley

03/14/24Summary: Whether you’re growing your portfolio or drawing it down, a Financial Advisor can introduce you to a range of tax-efficient solutions.

One way to potentially improve the net rate of return on your portfolio is to minimize the impact of taxes on your investments.

Consider tax loss harvesting in your portfolio

Under current US federal income tax law, you must pay taxes on any actual profits you make from selling an investment, such as appreciated shares of a company’s stock, during a given year. However, you can use a strategy known as tax-loss harvesting to reduce the amount of taxes you may owe on these profits, known as capital gains, by offsetting them with capital losses incurred during that year or carried over from a prior tax return.

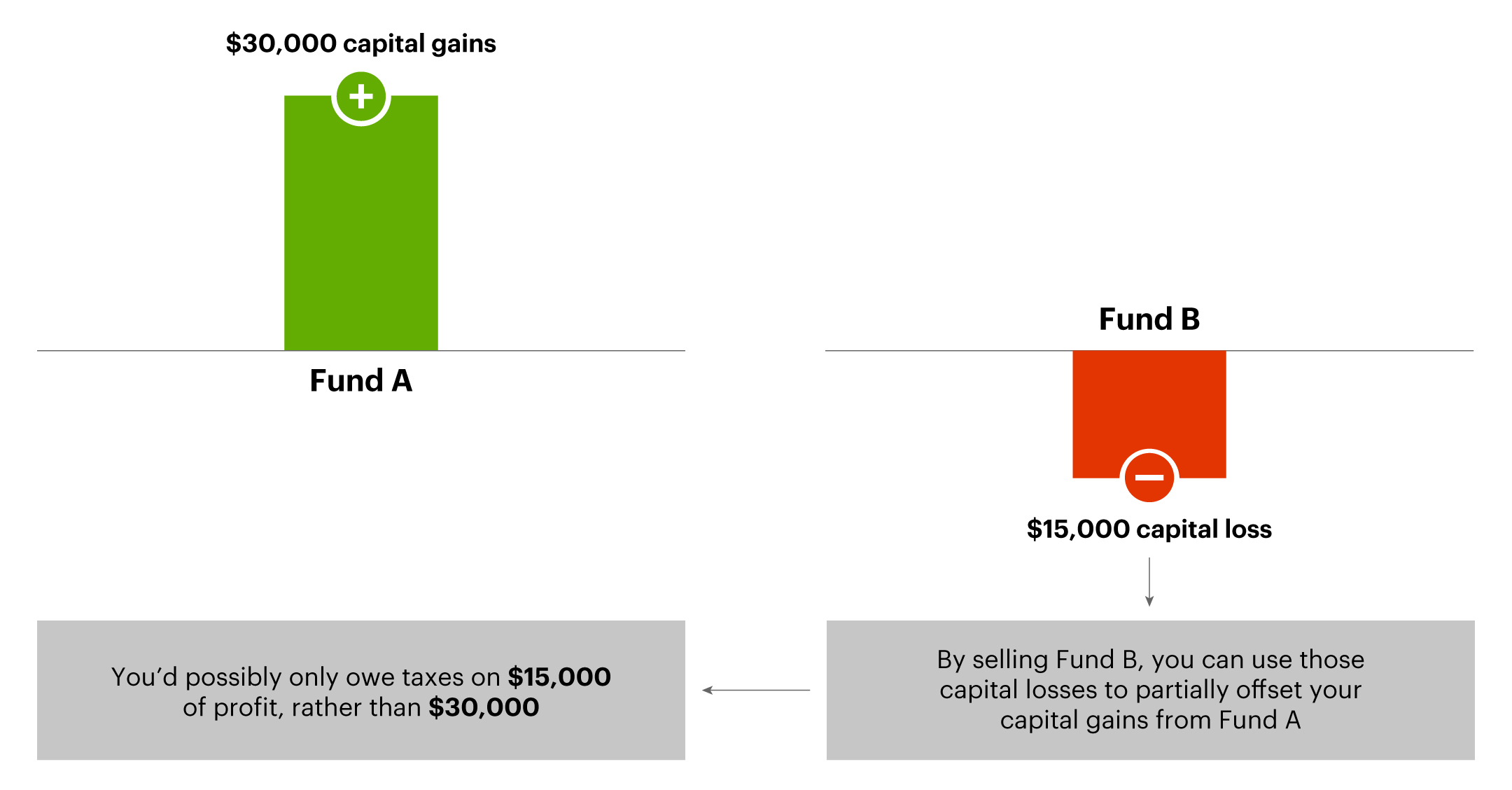

A hypothetical example: Let’s say you earn a profit of $30,000 by selling Fund A. Meanwhile, you notice that Fund B is down by $15,000. By selling Fund B, you can use those capital losses to partially offset your capital gains from Fund A—meaning you’d possibly only owe taxes on $15,000 of profit, rather than $30,000.

For illustrative purposes only. The example presented is hypothetical in nature and not intended to predict or project the performance of an actual investment. Actual results will vary.

“Harvesting” that $15,000 loss for tax purposes, in this case, would have no effect on the portfolio’s value, and you could use the proceeds from selling Fund B to buy a similar, but not the same, investment (subject to wash sale rules, which would disallow your current use of the tax loss if a “substantially identical” position were acquired). That would allow you to maintain roughly the same asset allocation, while possibly reducing your federal income taxes, potentially leaving you with additional funds that could remain invested and may continue to grow.

Tax loss harvesting can be beneficial, but it requires a disciplined approach, so if you’re going this route, you’ll want to dedicate time to monitor your portfolio and make changes as necessary.

That said, the approach you take to tax-loss harvesting may look different, depending on your current financial life stage and individual goals — like whether you are looking to grow your portfolio or need to start drawing it down. You may want to work with a tax advisor or check in with your accountant to confirm that your approach makes sense for your tax situation and a financial advisor to confirm that your approach makes sense for your financial situation.

If you’re growing your portfolio, consider direct indexing

This strategy seeks to replicate an existing stock index, such as the S&P 500 or the Russell 3000, in a taxable investment account.

How tax loss harvesting in direct indexing works

Through what’s known as a “separately managed account” that you own, an investment manager buys the individual stocks on your behalf that represents the chosen index. The manager can then sell individual positions that are down—“harvesting” the losses—which you can use to offset capital gains from other positions you have sold, including those from other asset classes or managers. This results in potential increased after-tax returns to grow your investments. Some investment managers offer systematic solutions, or direct indexing strategies, which automatically harvest tax losses year-round opportunistically while seeking to track the exposure of your chosen index.

Is it right for you?

When owning individual securities, direct indexing may require a relatively high minimum investment. Be prepared for possibly higher management fees than most common passively managed ETFs, but fees may actually be lower than an actively managed Mutual Fund in the same asset class. As such, if you’re interested in direct indexing but have assets held across multiple accounts at different institutions, you may need to consolidate your investments with a single Financial Advisor to realize the full potential of this strategy.

While not related to tax-loss harvesting, another benefit of direct indexing is the ability to customize your portfolio’s holding to your investing goals and values. For example, you can reduce your exposure to a specific stock or sector or avoid companies that engage in a practice you may not want to help promote like high carbon emissions.

If you’re drawing down your portfolio, consider sequencing withdrawals

There are many reasons you might draw down your portfolio, from paying for large purchases like a new car or a child’s school tuition to paying day-to-day expenses in retirement. When and how much money you take out of taxable, tax-deferred, and tax-exempt portfolios can have an impact on your tax bill.

How sequencing withdrawals work

When you make withdrawals, consider which types of accounts to tap as well as the long-term tax impact of the withdrawals on your portfolio. For example, taking some withdrawals from tax-deferred accounts early in retirement could help keep you in a lower tax bracket when you have to start taking required minimum distributions or RMDs.

When sequencing withdrawals, you can evaluate which securities within a taxable portfolio will generate tax gains or tax losses on sale. You can also evaluate which securities to sell based on how long you’ve owned them, in order to potentially meet the long-term capital gain holding period.

Is it right for you?

Sequencing withdrawals can be a cumbersome process, especially if you own many different types of securities in different types of accounts at different institutions.

Working with a Financial Advisor who has access to tools such as Morgan Stanley’s Intelligent Withdrawals can help make the process more manageable. With Intelligent Withdrawals, your Financial Advisor can run a sophisticated analysis across your accounts to provide withdrawal options that may help reduce the taxes you owe. The tool also helps your Financial Advisor consider your asset allocation, so that you can maintain the overall strategy for your portfolio after your sell decisions.

No matter which method you use, there’s no guarantee that tax-loss harvesting will achieve your desired tax result, or that it’s the best strategy for you. That’s why you may want to work with a tax advisor or check in with your accountant to confirm that your approach makes sense for your tax situation and a financial advisor to confirm that your approach makes sense for your financial situation.

The source of this article, “Tax-Smart Strategies For Selling Securities,” was originally published on October 4, 2023, and “How Direct Indexing Can Offer Investors Potential Tax Savings and Flexibility” was originally published on October 3, 2023.

How can E*TRADE from Morgan Stanley help?

Morgan Stanley Financial Advisors

Bring your future into focus

Eligible clients can get a goals-based plan and investing guidance from a Morgan Stanley Financial Advisor.

Traditional IRA

You may be eligible to make income tax deductible contributions

Earnings potentially grow tax-deferred until you withdraw them in retirement.

Visit the Tax Center

For additional tax-related information, including commonly asked questions, articles, and other tools, visit our Tax Center.

Premium Savings Account

Boost your savings with Annual Percentage Yield1

With rates 8X the national average2 and FDIC-insured up to $500,0003; certain conditions must be satisfied.

Morgan Stanley Private Bank, Member FDIC.