Hedging with gold

Given its low correlation with stocks and bonds, gold can provide an important role in portfolios: diversification. Gold’s ability to act as a “store of value” may provide ballast during times of market volatility and economic uncertainty. It can also serve as a hedge against rising inflation.* Since owning gold bars and coins (called bullion) requires delivery and storage of the physical asset, investors often look to funds for exposure to the precious metal.

ETFs

Rating

Change

Ratio

Data quoted represents past performance. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Your investment may be worth more or less than your original cost when you redeem your shares. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance and current performance metrics, please click on the fund name.

Get insights from Morgan Stanley

Hedging with gold: Could investing in gold make sense for you?

Gold vs silver: 4 key differences you should know

Check out other thematic investing topics

Playing defense

Find opportunities to invest in companies that may have the ability to weather tough economic times.

Government-backed bonds

Bolster your portfolio with funds that invest in US government backed bonds—widely considered the safest, lowest-risk securities available.

Health care innovators

Discover how to put your money behind health care and biotechnology companies that are pursuing medical breakthroughs.

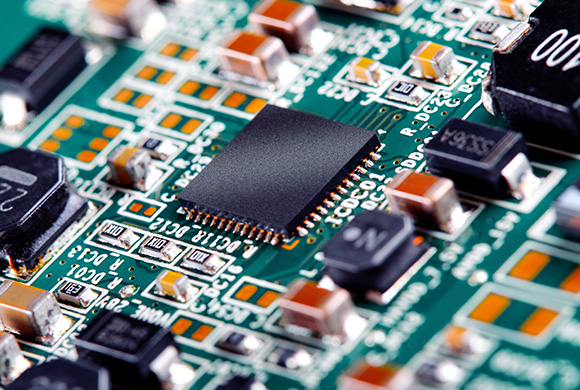

Technology pacesetters

Learn how to invest in leading technology innovators that are looking to change the way the world works.

Get up to $1,000 $1,500 for a limited time1

Open and fund a new brokerage account with a qualifying deposit by 6/30/2026. Learn how

Terms apply. Use promo code: OFFER26