What are the biggest myths about investing?

E*TRADE from Morgan Stanley

As investors today, we’re incredibly lucky. We have access to more information about the markets and investing than at any other time in history. Powerful digital tools enable us to research company financials and price history, get expert analysis, and much more—all in just seconds.

On the downside, though, having access to so much information can make it easy to be overwhelmed. Here are some of the biggest investing myths we’ve come across, along with some tips and pointers to help you stay focused.

1. You need a lot of money to invest.

We’ve all heard it before: “You have to have money to make money.” The thing is, it isn’t true. You can invest for the future even if you only have a few hundred dollars.

In fact, investing has never been more cost-effective. Trading commissions are lower than ever and there are literally hundreds of exchange-traded funds and mutual funds that can be bought free of commissions and with low expense ratios.

By investing what you can early, you have the potential to grow your savings into something much larger over time. Imagine, for instance, a $250 investment that’s able to grow at 7% a year. In 40 years, that could turn into more than $3,000. Invest $2,500 under the same circumstances, and that's more than $30,000. As investors, we call this compound interest.

2. “Buy and hold” is the way to go.

Many investors are taught that the best strategy is to buy and hold forever. While holding investments over the long run can reduce the impact of short-term market swings and mitigate emotional decisions, you shouldn’t buy a stock and then just close your eyes.

Sometimes, good companies fall out of favor or economies change. This can adversely affect the growth prospects for a company and depress its stock price.

Also, your financial circumstances and needs may change over time, requiring adjustments to your holdings. It’s always a good idea to review your portfolio and financial situation a couple of times a year. That way, you can adjust when your situation changes or when your portfolio’s drifted too far from your pre-set targets.

On the flip side, it’s important not to let your emotions get the best of you. Watching every rise and fall in one’s portfolio—especially when markets are volatile—can lead an investor to make decisions based on emotion, not on serious consideration of the underlying issues.

Here’s a tip that may help: Try to stick to a regular schedule for viewing—and rebalancing—your portfolio. This may keep you from checking in too often and getting caught up in the emotions of the moment.

In sum, it’s all about striking a balance. Don’t turn a blind eye to your investments, but at the same time, try not to emotionally react every time they rise or fall.

Try to stick to a regular schedule for viewing—and rebalancing—your portfolio. This may keep you from checking in too often and getting caught up in the emotions of the moment.

3. Only past performance matters.

Chasing performance—that is, purchasing investments just because they’ve done well in the past—is a risky business. You’re always looking in the rear-view mirror.

While historical data can be helpful, it’s important to remember: Past performance is no guarantee of future results. Consider choosing investments that fit your overall financial objectives, not just those that have been recent winners.

What you’re looking to achieve through your investments should guide the portfolio you create. Assembling stocks, bonds, mutual funds, ETFs, and cash in a balanced way may help reduce the overall risk of any one investment in your portfolio.

4. Avoid stocks when investing for retirement.

There's a common misconception that investors saving for retirement should ditch the stocks they own and invest only in bonds. In reality, though, it may be wise to hold both. Sure, stocks can be riskier, but having a combination of the two may help you grow your savings over time.

Even investors already in retirement may consider maintaining an allocation in stocks. For example, the 4% rule is a popular strategy that advises withdrawing 4% of one’s nest egg in the first year of retirement, and then adjusting future annual withdrawals for inflation. According to advocates of the strategy, one’s savings should then last for 30 years. To make the math work, however, the rule assumes that a portfolio has a healthy mix of stocks and bonds, thus enabling it to grow at a faster rate than bonds alone would generate.

For bond investing, ETFs and mutual funds may be good choices. These types of investments can give you exposure to the fixed income markets while also helping make the process simple and cost-efficient. But don’t forget: Just because bonds are considered lower risk doesn’t mean they’re risk-free.

If you own individual bonds instead of (or in addition to) bond funds, it’s important to monitor them regularly. That’s because a bond’s value relies on the issuer’s ability to keep up with its financial obligations. As a result, keep a close eye on your bonds and look for downgrades in credit ratings or news that may suggest challenges for the issuer.

5. Price charts are only for day traders.

Price charts for stocks are the primary tool of technical analysis, the study of the history of stock prices to try to identify trends and potentially forecast price movements.

While charts may be intimidating at first glance, they’re important tools—even among long-term investors—for learning how buyers and sellers of a security have shifted control back and forth, as well as what that might mean for the future.

One of the primary uses of price charts—for both traders and investors—is risk management. For instance, some investors use charts to help determine where to set prices for stop orders, automatic instructions to sell a security if it falls below a certain price level. Stop orders are intended to provide a degree of protection if the market moves against you.

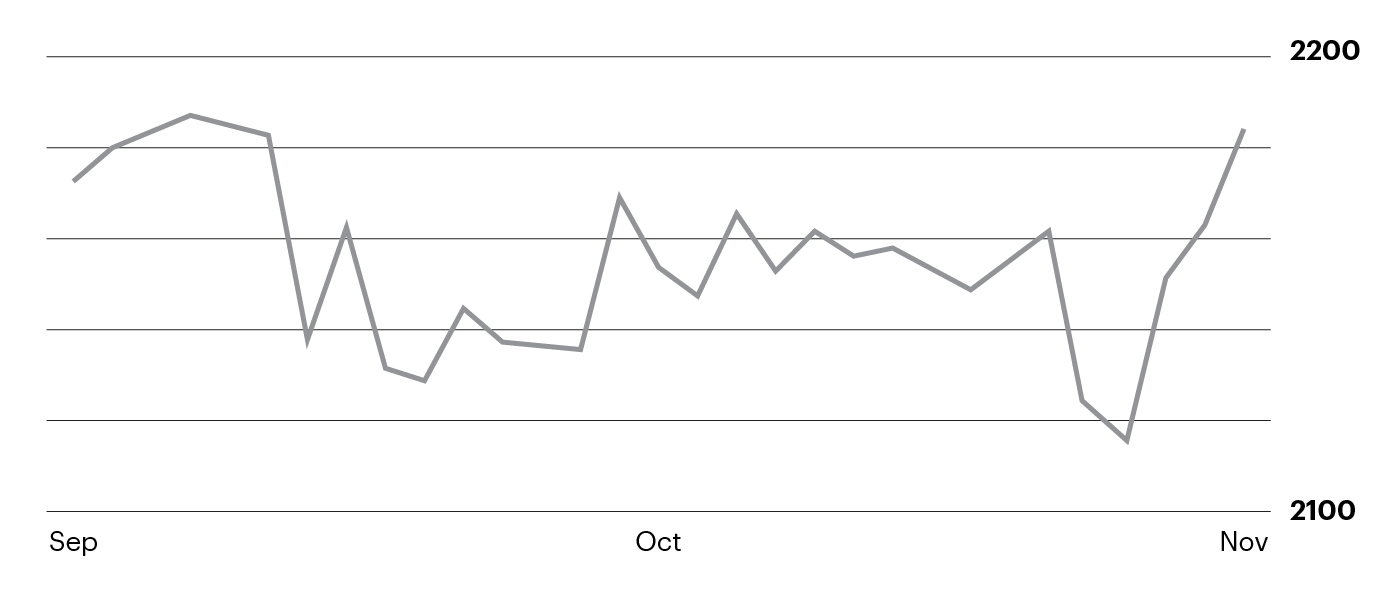

S&P 500 daily line chart: For illustration only, not a recommendation

How do I get started with technical analysis?

- Choose a chart type. There are line, bar, and candlestick charts in technical analysis. It's important to use the one that delivers the information most important to you.

- Identify trends in charts. One of the underlying assumptions of technical analysis is that stock prices tend to move in trends—up, down, or sideways.

- Determine support and resistance levels. These can help you understand a stock's price history and even estimate where to set stop prices.

- Place a trade or open an account. Come to any conclusions based on the charts you've studied? Now may be the time to put your analysis into action.

6. Always buy at or near the low.

Hoping to buy a security when it’s ready to rise from a low point is only natural. Buy low…sell high, right? It’s every investor’s dream.

The problem is: It’s much easier said than done.

When you buy a stock whose price is at a 52-week low, you’re essentially making a bet that your investment will be the catalyst that turns things around. However, if sellers of the stock are in control and have driven its price to such a major low, is it reasonable to think that you’re going to be able to predict the bottom?

Rather than investing a large amount of money at any one time, consider spacing out your purchases, a strategy known as dollar-cost averaging. This can help reduce the risk of buying too high—or of buying too big a stake in a stock that never recovers.

Knowing the risks associated with various investments and then managing those risks can provide the foundation for long-term success.

How can E*TRADE from Morgan Stanley help?

Savings and checking accounts

Ready to start saving more for your goals? Take a look at these account choices to find one that's right for you.

Core Portfolios

Automated investment management

Get a diversified portfolio that’s monitored and managed for a low annual advisory fee of 0.30% and $500 minimum.

Prebuilt portfolios

Select your risk tolerance and easily invest in diversified, professionally selected portfolios of mutual funds or exchange-traded funds (ETFs). And you pay no trading commissions.

Get started with as little as $500 (mutual funds) or $2,500 (ETFs).

Analyze your portfolio

Checking your portfolio periodically may help you make sure it's properly allocated and aligned with your goals. Our portfolio analysis tool can get you started.