Stocks absorb latest inflation data

- Consumer Price Index (CPI) came in above estimates

- Odds of rate cut tumbled below 20%

- Other CPI sell-offs followed by mixed stock returns

The third time was not the charm for the Consumer Price Index (CPI). After coming in above expectations in February and March, Wednesday made it three months in a row. And the pictures for the stock market and the odds for 2024 rate cuts were notably different before and after the report.

The odds of a June rate cut tumbled from above 50% before the release to 25% immediately after it, and to roughly 15% by Wednesday afternoon.1

The market’s immediate reaction to the report was more pronounced than after other recent releases. The June E-Mini S&P 500 futures (ESM4) were in positive territory for the day immediately before the CPI release. In the first minute after it, the market was down nearly 1%, and within 15 minutes the loss had expanded to -1.7%:

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

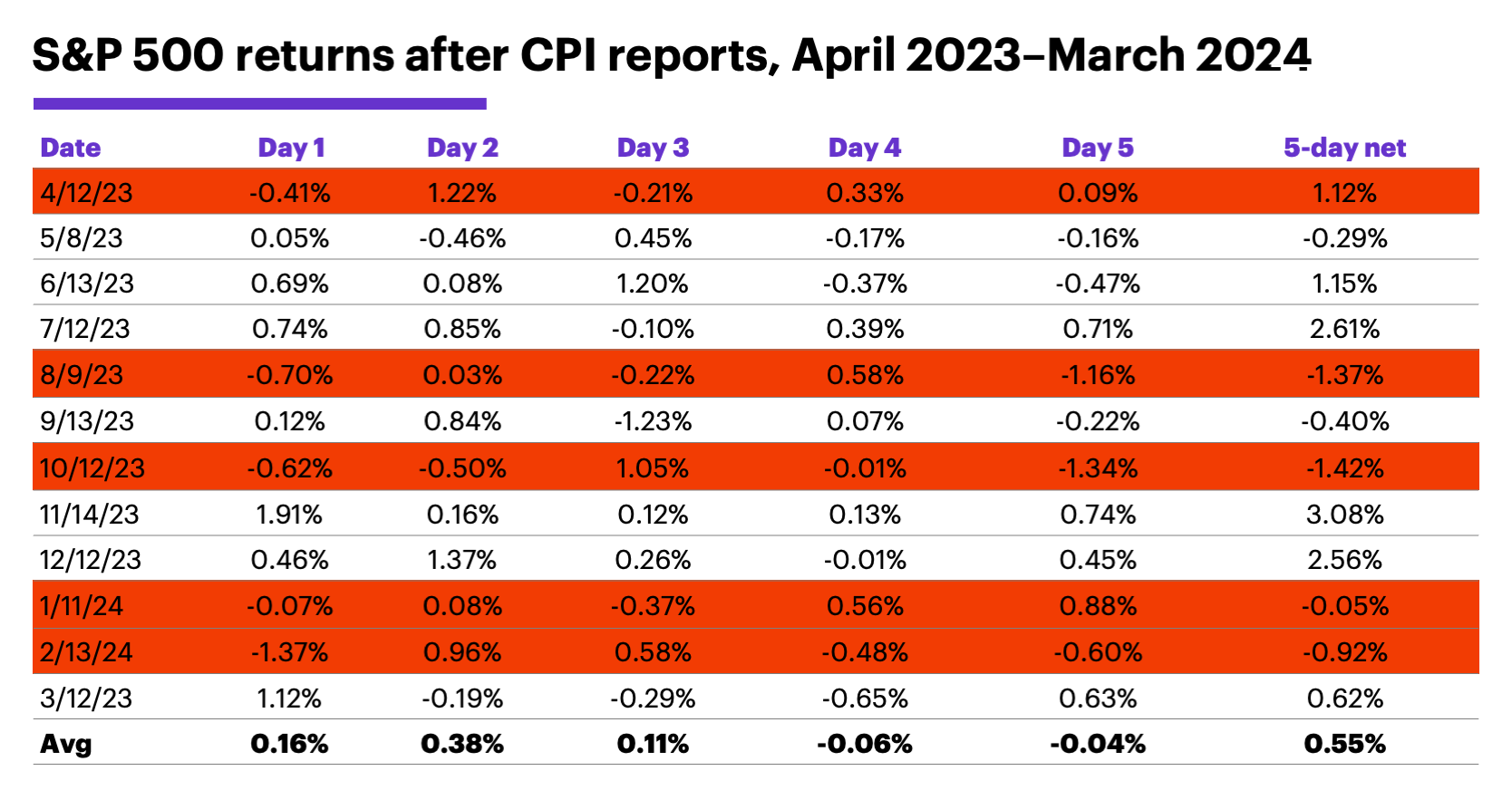

That weakness carried over to the rest of the day, with the SPX falling as much as 1.4% intraday—one of the larger sell-offs after a CPI release over the past year. The following table shows how the S&P 500 (SPX) performed in the first five days after the past 12 CPI releases (“Day 1” is the day of the report):

Source (data): Power E*TRADE (For illustration purposes. Not a recommendation. Note: It is not possible to invest directly in an index.)

This admittedly small sample highlights a couple of interesting tendencies. While the SPX has occasionally made big moves on a CPI release day, some of those moves were reversed, at least partially, over the next few days.

The SPX had a positive return on the day of a CPI release eight of 12 times, and had a positive five-day return in all but two of those cases. Also, except for one other case (March 2024), the five-day return was bigger than the Day 1 return, which means the SPX continued to rally.

After the four times the SPX fell on the day of a CPI release (highlighted rows), the SPX had negative five-day return three times. But in two of those cases (January and February 2024), the five-day net loss was smaller than the loss on the CPI release day, which means the SPX actually gained ground after the initial Day 1 loss.

Market Mover Update: After Wednesday’s rally, crude oil prices are again near their highest levels since October, and are up roughly 20% for the year. Morgan Stanley strategists recently discussed the factors driving the move, the possibility of additional upside, and the implications for the energy sector.2

Looks like someone may have adjusted a big position in the Industrial Select Sector SPDR ETF (XLI) yesterday? Fifty thousand contracts traded in both the $128 and $133 calls expiring on April 26, and both options had existing open interest (OI) of 50,000. At the same time, the $128 and $133 calls expiring on May 10 also had volume of 50,000 contracts (vs. OI of less than 50 for each). That means a trader could have been rolling a very large bull call spread forward to the May 10 options.

Today’s numbers include (all times ET): Jobless Claims (8:30 a.m.), PPI-Final Demand (8:30 a.m.), EIA Natural Gas Report (10:30 a.m.),

Today’s earnings include: Fastenal (FAST), CarMax (KMX), Constellation Brands (STZ).

Click here to log on to your account or learn more about E*TRADE's trading platforms, or follow the Company on Twitter, @ETRADE, for useful trading and investing insights.

1 CMEGroup.com. FedWatch Tool. 4/10/24.

2 MorganStanley.com. Thoughts on the Market: What is Driving Big Moves in the Oil Market? 4/9/24.