Diagnosing options activity

- EXAS jumped 13.1% to a seven-month high

- Stock pulled back intraday on heavy put volume

- Bears getting in, or bulls taking profits?

Exact Sciences (EXAS) was a market anomaly in many ways on Tuesday. First, the stock rallied to its highest levels since last September while the broad market was experiencing its biggest down day in four weeks.

But its rally differed from many of the day’s other notable gainers. After trading as much as 13.1% to the upside, EXAS quickly gave back nearly half that gain and spent much of the day in the middle of the day’s range:

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

Nonetheless, that made it one of the day’s 10-largest gains among stocks trading at $10 or higher, and was enough to put EXAS on the LiveAction scan for biggest percentage gainers.

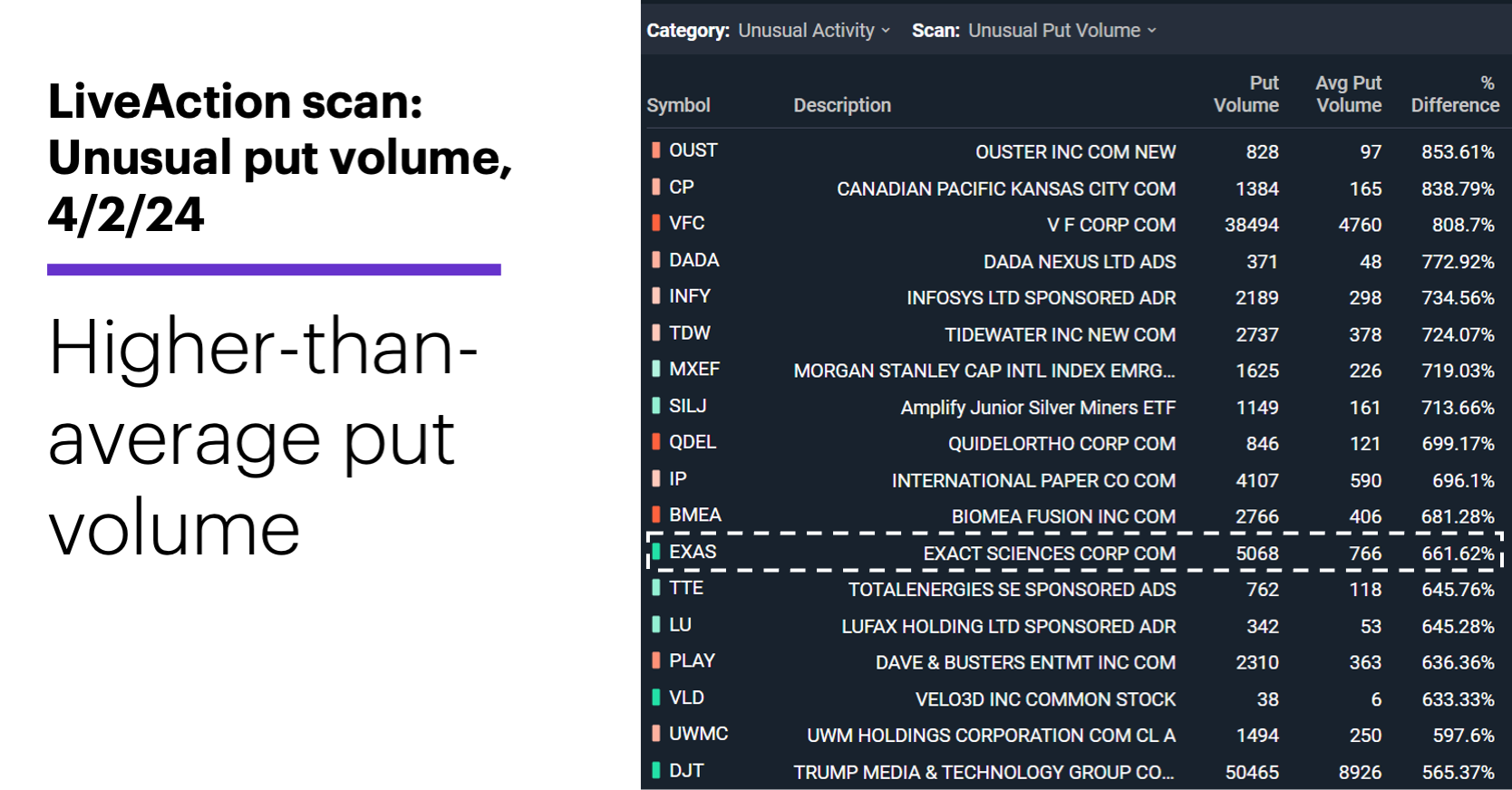

Then there was some counterintuitive options activity. While there was plenty of trading in both call and puts, put volume was more noteworthy, running nearly seven times average at midday:

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

Elevated put volume combined with a sharp intraday pullback may have led casual observers to think traders may have been positioning themselves for more downside—an idea that wouldn’t have been totally out of the blue, given the stock was up more than 40% from its late-February lows.

In that case, though, we’d expect at least some traders to be opening new put positions. In other words, if you think put activity is potentially bearish, it would support your argument if the people buying those puts were clearly getting into new trades, not covering existing short positions.

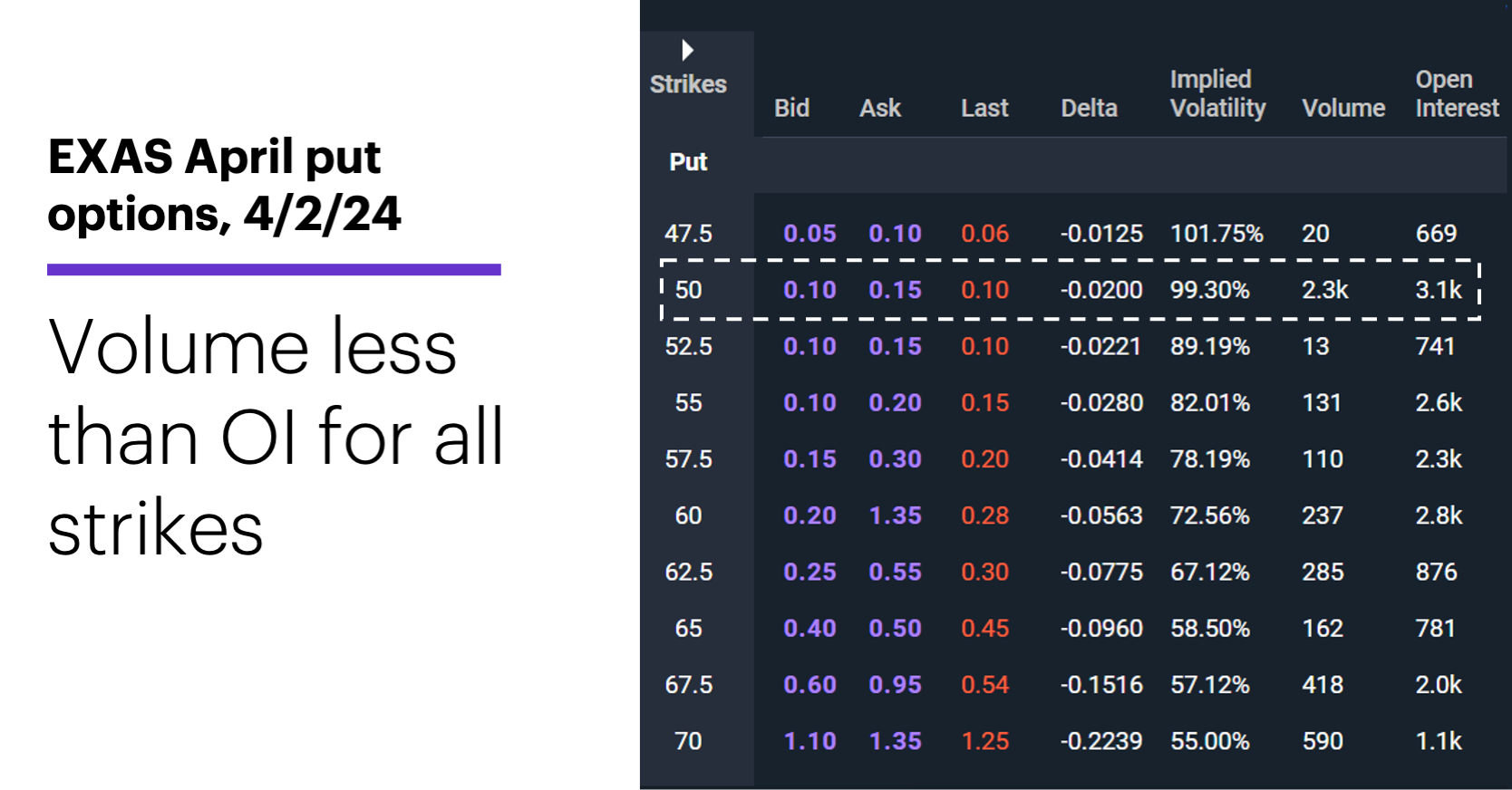

And as of yesterday, the jury was still out on that point. Of the more than 5,000 puts that changed hands by late morning, the majority were in the April monthly options, with the standout position being 2,300 contracts in the April $50 puts:

Source: Power E*TRADE (For illustration purposes. Not a recommendation.)

But not only was this volume less than the existing open interest (OI) of 3,100 contracts, the same held true for every strike price up to $70. And that means at least some of the trading in all these options could have been traders getting out of positions.

The only way to know whether traders had been, overall, opening new positions in EXAS puts or getting out of old ones would be to compare Wednesday’s OI to Tuesday’s OI and see if it had increased or decreased. Higher OI means traders were getting in, lower OI means they were getting out.

In the case of the April $50 puts, more than 3,300 contracts traded between March 1-20 when the stock was still relatively close to its 13-month lows. It’s not a stretch to think that bears who bought these puts (and bulls who shorted them) at prices between $1-$2.60 during this period decided to get out of at least some of their positions as yesterday’s rally dropped their value as low as $0.05.

Nothing in the markets is etched in stone, but knowing which way options traders were leaning may help put the stock’s recent price action in better focus.

Market Mover Update: The commodity train kept rolling yesterday. May WTI crude oil futures (CLK4) rallied to a contract-high $85.50, while gold hit another record high, with June futures (GCM4) topping $2,300 intraday. May cocoa tagged a new all-time high of $10,324/ton before closing lower on the day.

Today’s numbers include (all times ET): OPEC meeting, mortgage applications (7 a.m.), ADP Employment Report (8:15 a.m.), PMI Composite (9:45 a.m.), ISM Services Index (10 a.m.), EIA Petroleum Status Report (10:30 a.m.), Fed Chair Jerome Powell speaks at the Stanford Business, Government, and Society Forum (12:10 p.m.).

Today’s earnings include: Acuity Brands (AYI), Levi Strauss (LEVI).

Click here to log on to your account or learn more about E*TRADE's trading platforms, or follow the Company on Twitter, @ETRADE, for useful trading and investing insights.