November pivot

E*TRADE from Morgan Stanley

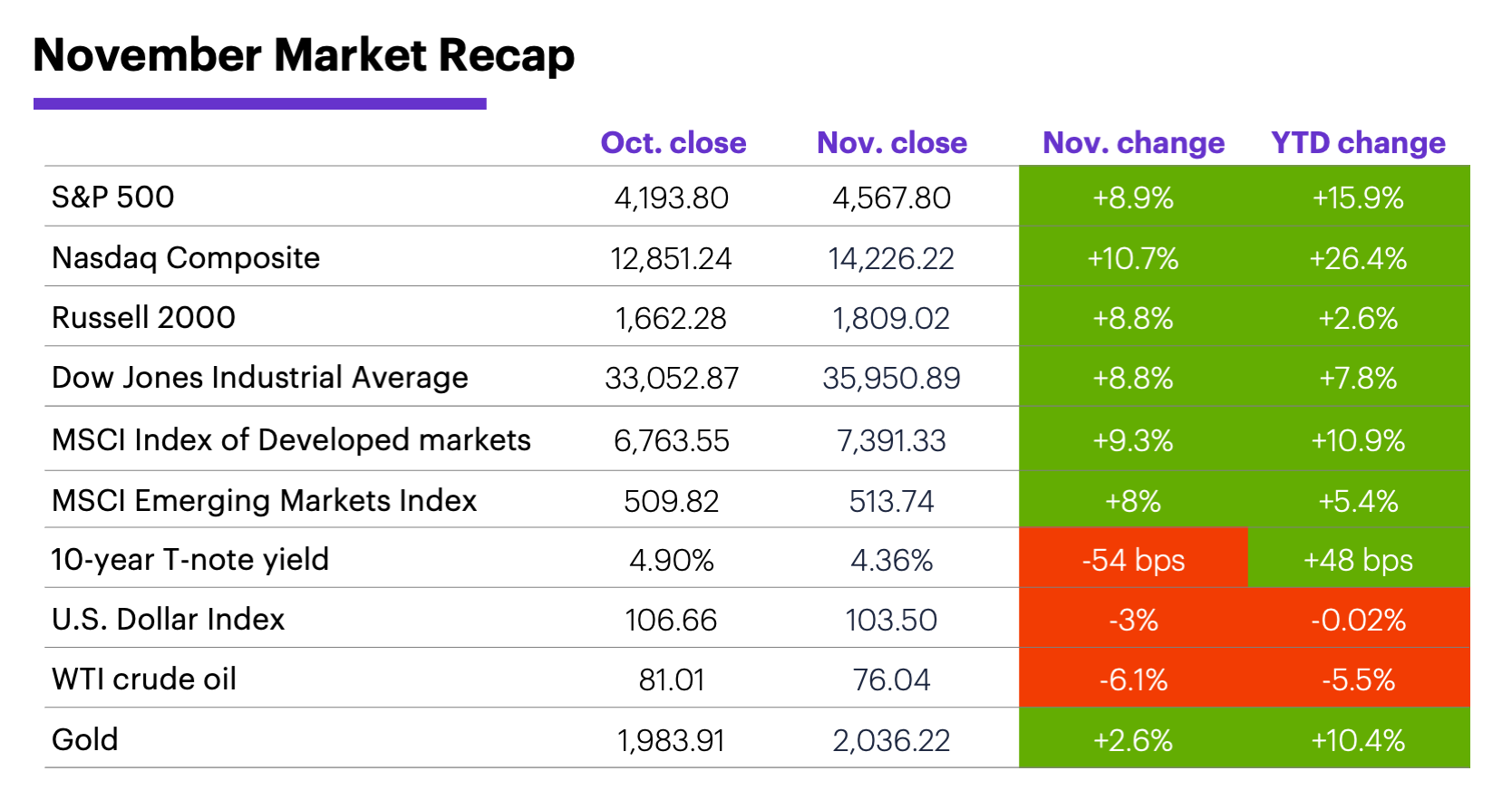

US stocks are coming off their second-strongest November of the past four decades amid signs of cooling inflation and a slowing US economy. Despite a late-month pause, the S&P 500 ended November near its highest levels of the past four months.

The rally dramatically changed the market picture from late October, when the S&P 500 was trading at a five-month low and both the Dow Jones Industrial Average and the small-cap Russell 2000 were in negative territory for the year.

Globally, developed markets were slightly stronger than the S&P 500, while emerging markets were somewhat weaker. Bond prices mostly climbed in November, as yields—especially for longer maturities—retreated from the multi-year highs they hit in late October.

Source (data): Power E*TRADE. (For illustrative purposes. Not a recommendation. It is not possible to invest directly in an index.) Note: Crude oil, gold, and U.S. Dollar Index data reflect spot-market prices. BPS (basis point) = 0.01%.

Sectors highlight “risk-on” pivot. The market-leading performance of the S&P 500 tech sector (+12.9%) and the tech-heavy Nasdaq Composite underscored last month’s shift back toward mega-tech names. Meanwhile, defensive sectors like health care, utilities, and consumer staples were among the weaker performers, although all were positive for the month. The notable outlier was energy—the only sector to lose ground in November, as crude oil prices fell for a second-straight month.

Insights of the month. As artificial intelligence (AI) and anti-obesity drugs (AOD) continued to make headlines, Morgan Stanley & Co. analysts argued AI may be moving in an unexpected direction,1 while the ripple effects of AODs may have implications for a wider range of industries than many people think.2

Morgan Stanley strategists expect the economy to slow in 2024—which could weigh on corporate earnings—but also anticipate the Fed could begin cutting interest rates in June.

Amid the signs of an economic slowdown, one question is whether the consumer will continue to fuel the US economy. In the near-term, Morgan Stanley & Co. analysts think the holiday shopping season may be a mixed bag, and they suspect consumer spending will decline more meaningfully in 2024.3

That outlook could jibe with the broader outlook for next year. Morgan Stanley strategists expect the US (and global) economy to slow further in 2024—which may weigh on corporate earnings—while also anticipating the Fed could begin to cut interest rates in June.4 In the meantime, companies with “cost leadership or operational efficiency” could continue to outperform into the first half of next year.5

Finally, December has historically been one of the stronger months for US stocks, although it’s been slightly less so over the past couple of decades. From 1982–2001, December was a positive month 85% of the time, with an average SPX return of 2.3%, second only to January. Since then, December has been a positive month 70% of the time, with a 1.1% median return (seventh highest).6

1 MorganStanley.com. The Cutting Edge of AI. 11/20/23.

2 MorganStanley.com. Weight Loss Drugs and the Global Economy. 11/09/23.

3 MorganStanley.com. U.S. Consumer: Mixed Holiday Spending Expectations? 11/22/23.

4 MorganStanley.com. 2024 U.S. Economic Outlook. 11/17/23.

5 MorganStanley.com. Macro Economy: The 2024 Outlook. 11/13/23.

6 All figures reflect S&P 500 (SPX) monthly closing prices, 1/2/82–12/31/22. Supporting document available upon request.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Technology stocks may be especially volatile. Risks applicable to companies in the energy and natural resources sectors include commodity pricing risk, supply and demand risk, depletion risk and exploration risk. Health care sector stocks are subject to government regulation, as well as government approval of products and services, which can significantly impact price and availability, and which can also be significantly affected by rapid obsolescence and patent expirations.

Yields are subject to change with economic conditions. Yield is only one factor that should be considered when making an investment decision.