Market haves and have-nots

E*TRADE from Morgan Stanley

After another month of tech-fueled gains, the US stock market enters the second half of 2024 in a familiar place—near all-time highs.

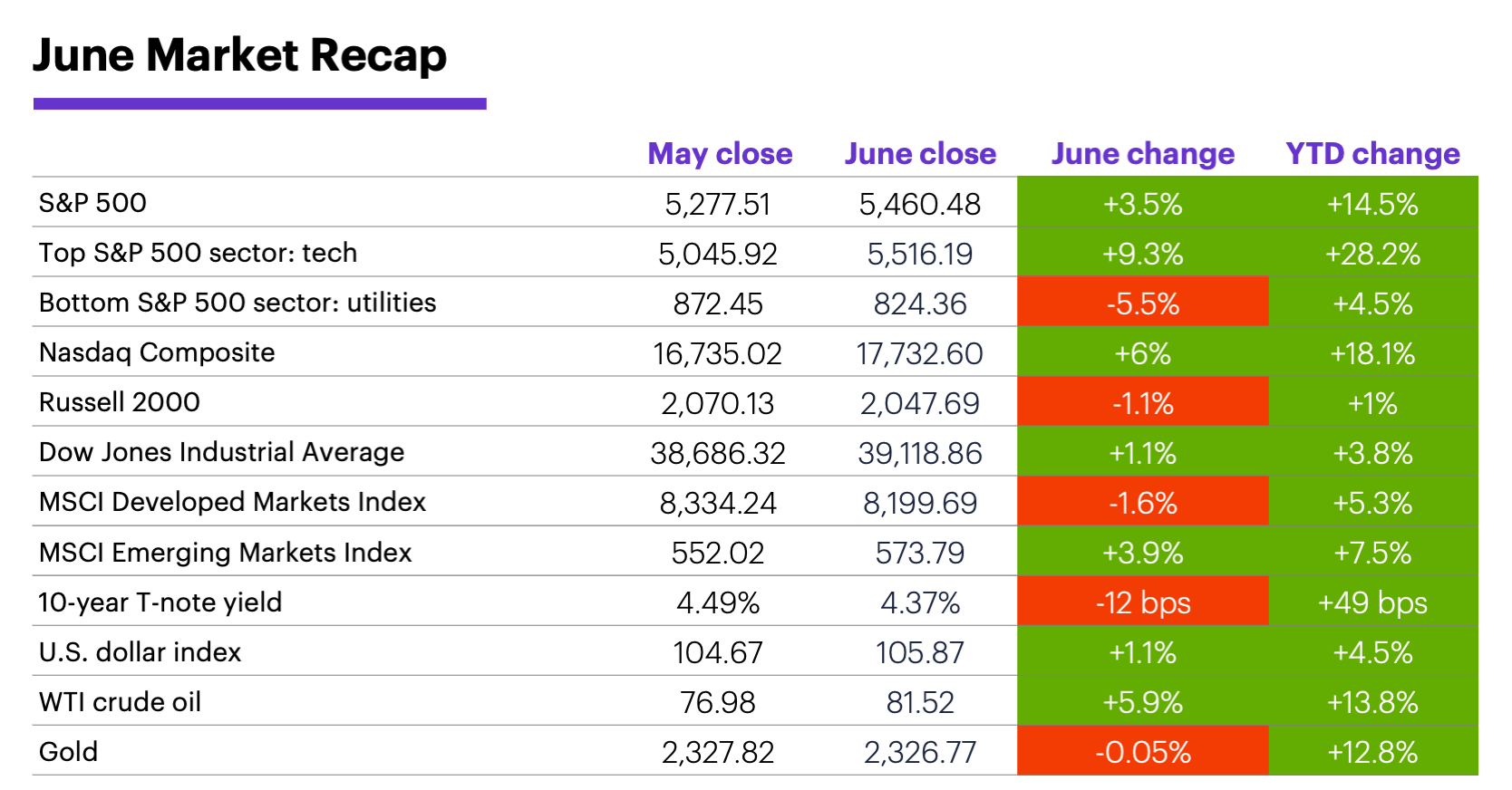

Stocks padded their gains in June amid signs of cooling inflation and a slowing economy, feeding anticipation of Fed rate cuts later this year. It was the S&P 500’s seventh positive month of the past eight, and its 14.5% first-half gain was its 13th largest since 1957.

But those milestones continued to be driven by narrow market leadership. While large caps, especially megacap tech names, enjoyed the bulk of the month’s gains, the Russell 2000 small cap index posted a net loss. Although Morgan Stanley & Co. analysts pointed out market breadth is as weak as it’s been since 1965, they don’t expect the rally to widen meaningfully in the near future. Until macro conditions change, they argue, current circumstances call for favoring large cap quality growth and defensives, while fading cyclical stocks.1

Data source: Power E*TRADE and FactSet. (For illustrative purposes. Not a recommendation. It is not possible to invest directly in an index.) Note: crude oil, gold, and U.S. Dollar Index data reflect spot-market prices. BPS (basis point) = 0.01%. MSCI Index of Developed Markets and MSCI Emerging Markets Index represent “total-return” performance (index change including dividend reinvestment).

June’s sector performance also highlighted a “haves and have-nots” dynamic. Even though the S&P 500 gained ground for the month, more sectors were negative than positive. Five sectors rallied last month, led by tech, while six lost ground, with utilities taking the biggest step back.

Meanwhile, bond prices mostly rose as yields declined for a second-straight month. The benchmark US 10-year Treasury yield fell to its lowest level since late March in the middle of June, but rebounded to end the month just 12 basis points lower at 4.37%.

International equities were a mixed bag. The MSCI Emerging Markets Index outperformed the S&P 500 in June (India was particularly strong), while the MSCI Developed Markets Index, weighed down by weakness in Europe (especially France), lost ground for the month.

Easing inflation numbers last month kept investors looking ahead to Fed rate cuts, although timing remains uncertain. Despite the inflation cooldown, Morgan Stanley & Co. pointed out the services side of the economy poses the biggest risk: If those numbers remain “sticky,” the Fed could err on the side of caution and leave interest rates higher for longer. That said, the analysts’ base case is for one cut in September, one in December, and another four next year.2

Stronger-than-average first halves for the stock market have, more often than not, been followed by stronger-than-average second halves.

Insight of the month: Playing smart defense. Investors uncomfortable with the current market leadership in the face of stretched momentum, weak breadth, and political uncertainty, may consider playing a bit of defense, according to Morgan Stanley Wealth Management. That could include focusing on pockets of the market containing “growth at a reasonable price,” including in health care, industrials, aerospace/defense, select power generation and grid infrastructure stocks, financials, and residential REITs.3

Looking ahead to July. From 1957-2002, July was a down month for the S&P 500 more often than it was an up one. But over the past two decades, it was positive 15 out of 20 times, including in nine of the past 10 years. And looking further ahead, although the S&P 500’s first-half return was much larger than average, that doesn’t necessarily signal the market will run out of gas in the second half—since 1957, the 15-strongest first halves have, more often than not, been followed by stronger-than-average second halves.4

Key dates: Jobs report (7/5), CPI (7/11), PPI (7/12), Retail Sales (7/16), Housing Starts (7/17), Durable Goods Orders (7/25), PCE Price Index (7/26), Fed interest rate announcement (7/31).

1 MorganStanley.com. Navigating the Narrow Stock Market. 6/25/24.

2 MorganStanley.com. Economics Roundtable: Investors Eye Central Banks. 6/21/24.

3 MorganStanley.com. The GIC Weekly: Redefining “Defense.” 7/1/24.

4 Figures reflect S&P 500 (SPX) monthly closing prices, 1957–2023. Supporting document available upon request.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Technology stocks may be especially volatile. Risks applicable to companies in the energy and natural resources sectors include commodity pricing risk, supply and demand risk, depletion risk and exploration risk. Health care sector stocks are subject to government regulation, as well as government approval of products and services, which can significantly impact price and availability, and which can also be significantly affected by rapid obsolescence and patent expirations.

Yields are subject to change with economic conditions. Yield is only one factor that should be considered when making an investment decision.