Stocks march on

E*TRADE from Morgan Stanley

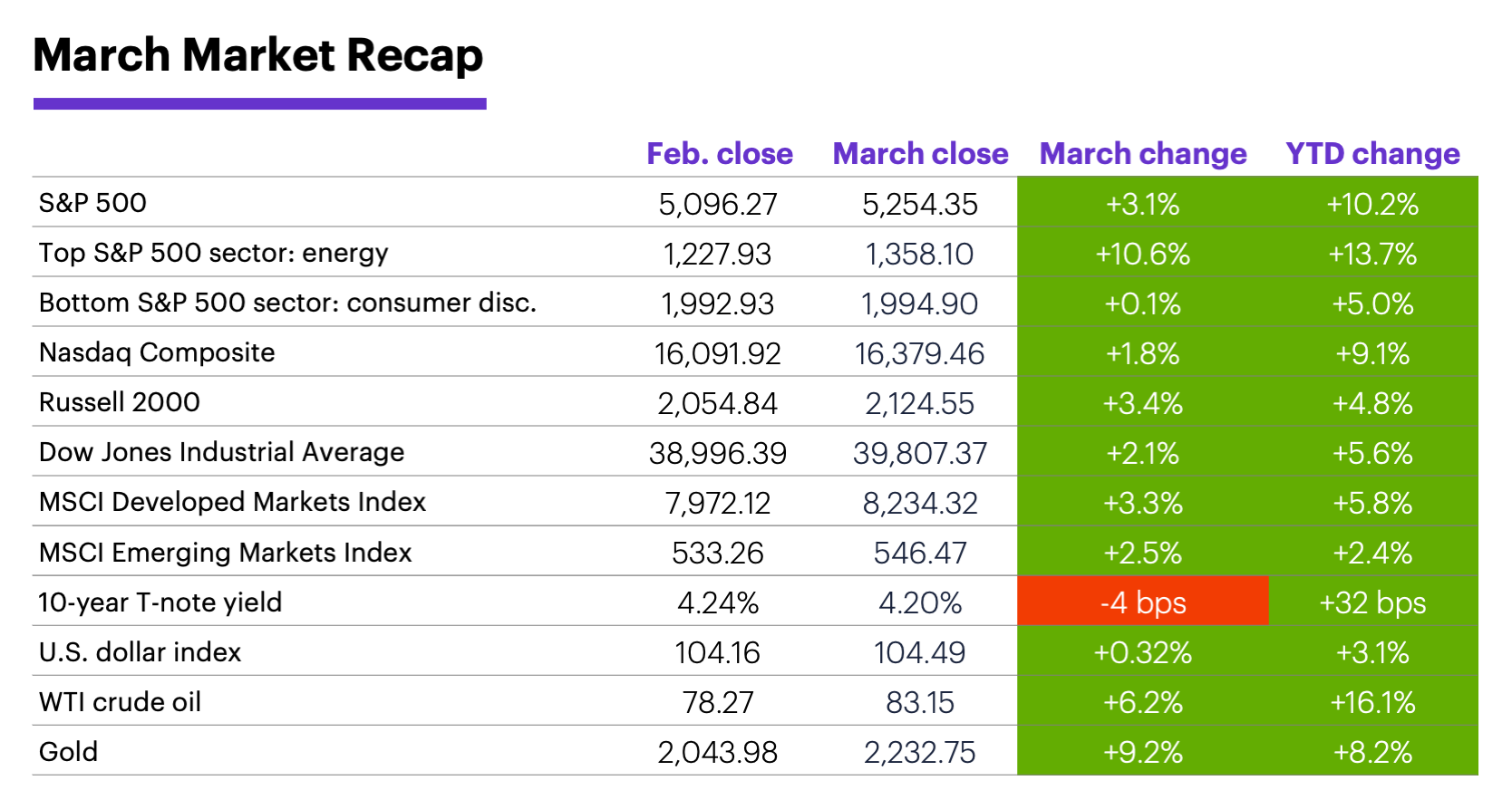

The stock market rally may have lost a little momentum in March, but the S&P 500 still logged its fifth-straight positive month, its second-strongest Q1 return of the past decade, and ended the month at a new record high.

Unlike February, however, tech didn’t lead the market to the upside. That honor went to the energy sector, which rallied as crude oil prices climbed to their highest level since October. Consumer discretionary was the weakest sector in March, although it posted a marginal gain.

Bond prices ended March little changed, but not without some volatility: Yields fell to a five-week low early in the month, but quickly rebounded to test their highest levels of the year. The benchmark 10-year Treasury yield ended March four basis points lower at 4.2%.

Data source: Power E*TRADE and FactSet. (For illustrative purposes. Not a recommendation. It is not possible to invest directly in an index.) Note: crude oil, gold, and U.S. Dollar Index data reflect spot-market prices. BPS (basis point) = 0.01%. MSCI Index of Developed Markets and MSCI Emerging Markets Index represent “total-return” performance (index change including dividend reinvestment).

Relative strength in global equity markets, especially developed markets, was a noticeable departure from the first two months of the year. Global investment themes recently explored by Morgan Stanley & Co. strategists include the potential for secular bull markets in Japan and India,1 as well as possible strength in the European financial sector.2

Inflation climbed for a second-straight month, with the Consumer Price Index (CPI) and Producer Price Index (PPI) both surprising to the upside. But one week after those reports renewed concerns about delayed rate cuts, the Federal Reserve signaled it was still on course to trim rates three times in the second half of the year. Also, on the final day of the month, the PCE Price Index showed more moderate inflation levels. Although the picture could change significantly over the next 10 weeks, at the end of March, the odds of a June cut were around 60%.3

Commodities elbowed their way into the headlines in March. US crude oil prices posted their biggest monthly gain since July 2023 and climbed above $80 for the first time this year, while gold rallied to all-time highs above $2,200. Meanwhile, cocoa prices continued their record-setting rally, gaining nearly 51% last month and extending their year-to-date return to 132%.

The S&P 500’s Q1 return was its 11th-strongest since 1950.

Insight of the month. Inflation and commodity prices dovetailed in a recent Morgan Stanley & Co. discussion, which noted stock investors appear to have moved past the Fed, inflation, and interest rates. According to the strategists, signs of broadening market leadership may favor industrial stocks (along with energy, materials, and utilities), as investors rotate from expensive tech winners to cheaper stocks that may do better in an environment with higher commodity prices.4

Market calendar. Since even the strongest rallies experience setbacks—the S&P 500 just posted five-consecutive up months for only the second time since 2021—a pullback this month would hardly be out of the question. That said, April has been one of the most consistently positive months of the year, with the S&P 500 gaining ground in 73% of Aprils since 1957, 80% since 1994, and nine of the past 10.5 However, the gains themselves have been somewhat middle of the road: April’s 1.2% median return since 1957 ranks sixth among all months of the year.

1 MorganStanley.com. Asia Equities: A Quarter of Dispersion. 3/19/24.

2 MorganStanley.com. European Financials: Why Confidence Has Returned. 3/21/24.

3 CMEGroup.com. FedWatch Tool. 3/28/24.

4 MorganStanley.com. Finding the Equity Sweet Spot. 3/18/24.

5 Figures reflect S&P 500 (SPX) monthly closing prices, 1957–2024. Supporting document available upon request.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Technology stocks may be especially volatile. Risks applicable to companies in the energy and natural resources sectors include commodity pricing risk, supply and demand risk, depletion risk and exploration risk. Health care sector stocks are subject to government regulation, as well as government approval of products and services, which can significantly impact price and availability, and which can also be significantly affected by rapid obsolescence and patent expirations.

Yields are subject to change with economic conditions. Yield is only one factor that should be considered when making an investment decision.