Growth vs. value investing

E*TRADE from Morgan Stanley

04/04/25Summary: Growth and value are two foundational equity investing strategies. While their approaches may differ, discover how incorporating either or both strategies can potentially enhance and diversify your portfolio.

There are so many ways to invest, but growth and value are two broad, yet essential equity investing strategies that every new or seasoned investor should know.

Which style generates better returns has varied over different time periods, as each approach has its own unique set of characteristics and potential opportunities. Before investing, it is important to know the style that best suits your financial objectives.

Here are the potential advantages and differences of each strategy.

Growth investing

With growth investing, investors aim to buy the stocks of companies that have rapid growth potential in revenues and profits. Growth stocks will typically have a high price-to-earnings ratio because investors are optimistic their future profits will exceed the price of the stock trading at a premium. In short, growth investors are focused on capital appreciation.

Rather than pay dividends, firms often reinvest their profits to further grow the company. This setup can benefit growth investors, who are typically hoping to experience capital appreciation through rising stock prices. Growth investors are also willing to accept greater volatility risk, which may come with more aggressive growth stocks.

Growth stocks are largely available in any industry, especially technology. You may find growth companies to be:

- Innovators or part of an emerging industry like artificial intelligence,

- Growing sales and earnings faster than economic growth would suggest through exercising competitive advantage,

- Positioned to profit from major social trends.

Many companies in the value category often use their earnings to pay dividends, which can be a significant component of these stocks’ total returns to investors.

Value investing

Value investing involves purchasing stocks that may be underpriced because the market is likely not valuing the company’s real worth or future prospects.

Some undervalued firms may have had recent setbacks, causing their stock price to fall, or they may be in sectors that are currently out-of-favor with investors. Value investors hold on to the stocks with the expectations of seeing returns when the price increases after the market recognizes their actual value.

Many companies in the value category are mature, established firms that may have slower growth rates. Often, they use their earnings to pay dividends, which can be a significant component of these stocks’ total returns to investors.

On the risk side, higher-quality value stocks are typically (though not always) less volatile than growth stocks, meaning investors normally expect to experience slower and less dramatic price drops and swings.

Value stocks are often found in established industries like:

- Energy

- Financials

- Consumer staples

What's the difference?

Growth investing

Valuations

Generally higher

Earnings

Rapid growth potential

Volatility

Medium to high

Industries

Tech, Communication Services, Consumer Discretionary

Beneficial markets

Periods of rapid technological innovation; often better in bull markets

Value investing

Valuations

Typically lower

Earnings

Steady, supporting dividends

Volatility

Low to high

Industries

Energy, Financials, Consumer Staples

Beneficial markets

Typically bear markets for defensives; following bear markets for early cyclicals

Which style performs better?

There’s no simple answer to which approach provides better returns—it depends a lot on timing and the market.

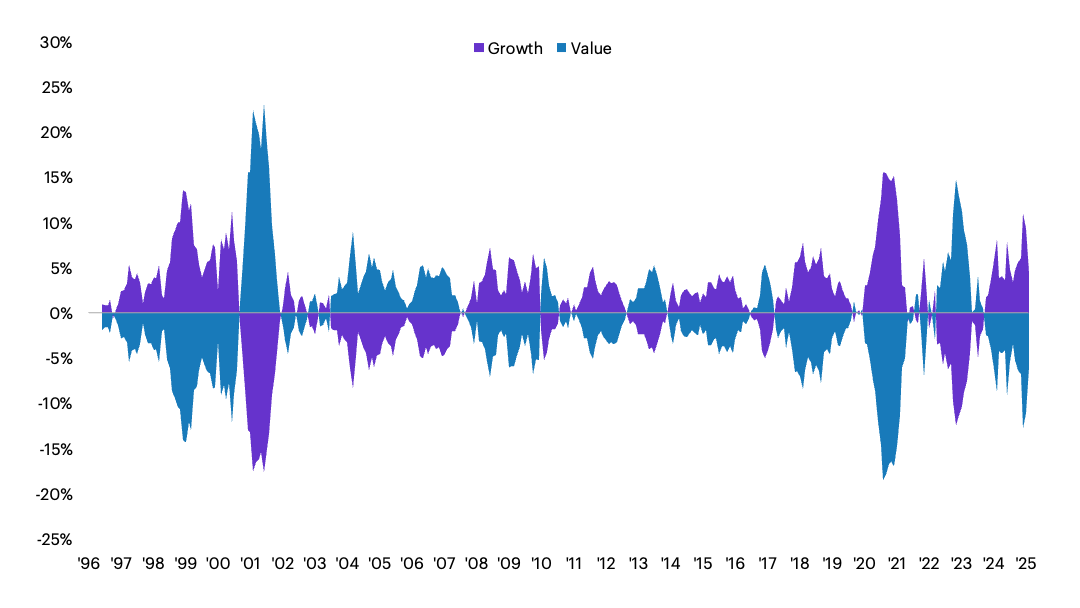

It’s important to know that the two approaches typically move in contrast with each other — that is, when value is performing well, growth often lags, and vice-versa.

Although past performance is not indicative of future results, growth has historically been the stronger performer in bull markets more often, benefiting more from periods of economic expansion, while value has done better in bear markets, making good use of economic downturns and their immediate recoveries.

The following chart illustrates the cyclical pattern of growth vs. value from 1996 to 2025.

US equity excess performance by growth vs. value factors

Past performance is no guarantee of future results.

Source: Bloomberg, Morgan Stanley Wealth Management GIO.

Growth is represented by the S&P 500 Growth Index; Value by the S&P 500 Value Index. An investment cannot be made directly in a market index.

Choosing a style that works for you

Investors may prefer one style over the other depending on their perspective of the market. Some may even incorporate both investing styles—either to diversify or to try to take advantage of market trends—in hopes that their portfolio captures the better returns, regardless of which approach the market favors at any given time.

CRC# 4091966 04/2025

How can E*TRADE from Morgan Stanley help?

Brokerage account

Investing and trading account

Buy and sell stocks, ETFs, mutual funds, options, bonds, and more.

Review your portfolio’s performance

Use our interactive charts to view your rates of return over various time periods and compare your portfolio against multiple benchmarks.

Prebuilt Portfolios

Select your risk tolerance and easily invest in diversified, professionally selected portfolios of mutual funds or exchange-traded funds (ETFs). And you pay no trading commissions although fund fees and expenses still apply.

Get started with as little as $500 (mutual funds) or $2,500 (ETFs).

Undervalued large firms

Consider putting your money in large companies whose stocks may be underpriced based on the principles of value investing.