Will war in Ukraine, Israel and the Middle East impact financial markets?

Morgan Stanley Wealth Management

11/30/23Summary: Navigating the market during times of global conflict can be challenging. Here’s what investors should know to help safeguard your portfolio.

With ongoing conflicts in Ukraine and the Middle East dominating the headlines, the world has never felt more volatile. But does that volatility extend all the way to the market? Not always.

As investors seek to understand and manage their risk, now may be a good time to consider the impact world events like war can have on their portfolios.

Understanding market reactions to war

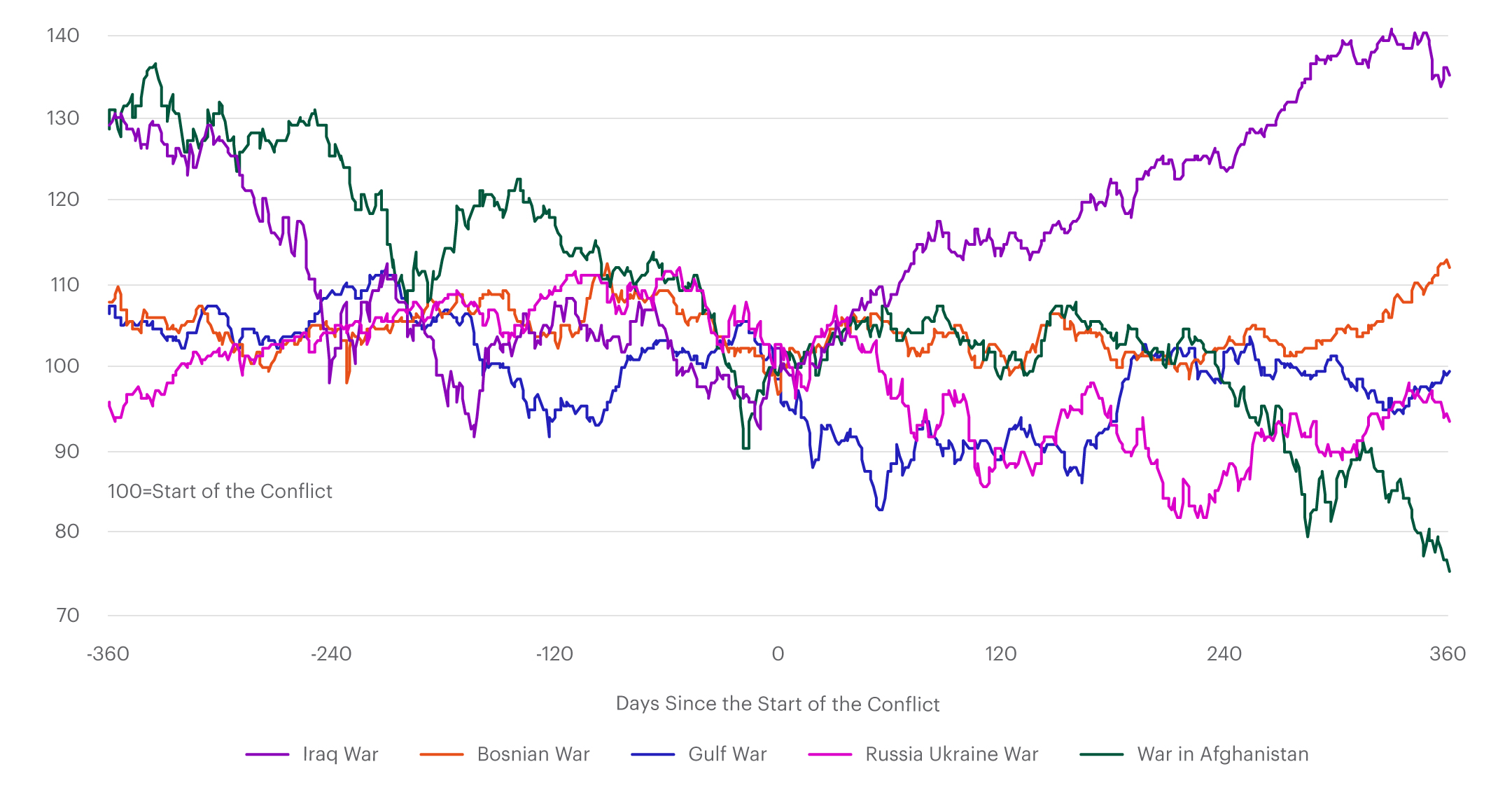

It can be logical to read the news and assume that geopolitical events like war will negatively impact global investments. However, investors can look back at how the market performed during other recent conflicts to see if there is a correlation.

By looking at the historical performance of the MSCI All Country World Index, which is a comprehensive gauge of global stock market performance, you can see that the threat of ongoing war doesn’t always impact investor returns.1 In fact, investors earned higher returns in the twelve months following the start of the Iraq War, Bosnian War, and Gulf War.

Stocks Often Shrug at Geopolitical Conflict1

MSCI All Country World Index. Note: Iraq War began March 20,2003; Bosnian War, April 6, 1992; Gulf War, August 2, 1990; Russia-Ukraine War, February 24,2022 and War in Afghanistan, October 7, 2001.

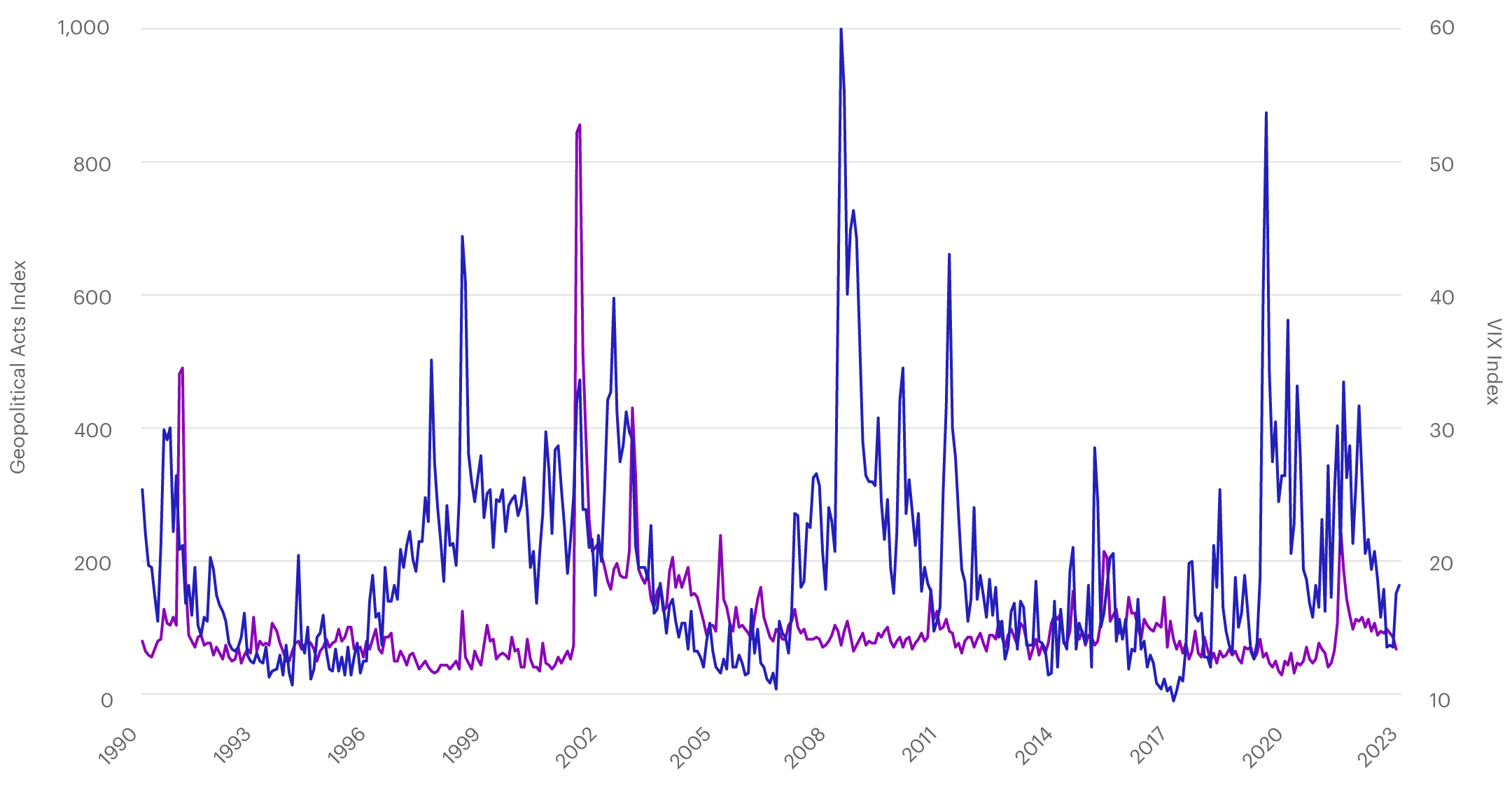

Not only that, but geopolitical conflict has little connection to market volatility. This is in stark contrast to the dotcom bust, Great Financial Crisis and the Covid-19 pandemic. For example, one study by the National Bureau of Economics found that stock volatility was 33% lower than usual during wars and other periods of conflicts, while a comparison of the VIX Index, which measures US stock market volatility, has almost zero correlation with adverse geopolitical events as measured by the Federal Reserve’s Geopolitical Acts Index.2

Geopolitical Risk Creates Uncertainty, but Not Unusual Stock Volatility2

What about today’s conflicts? Will they upset markets?

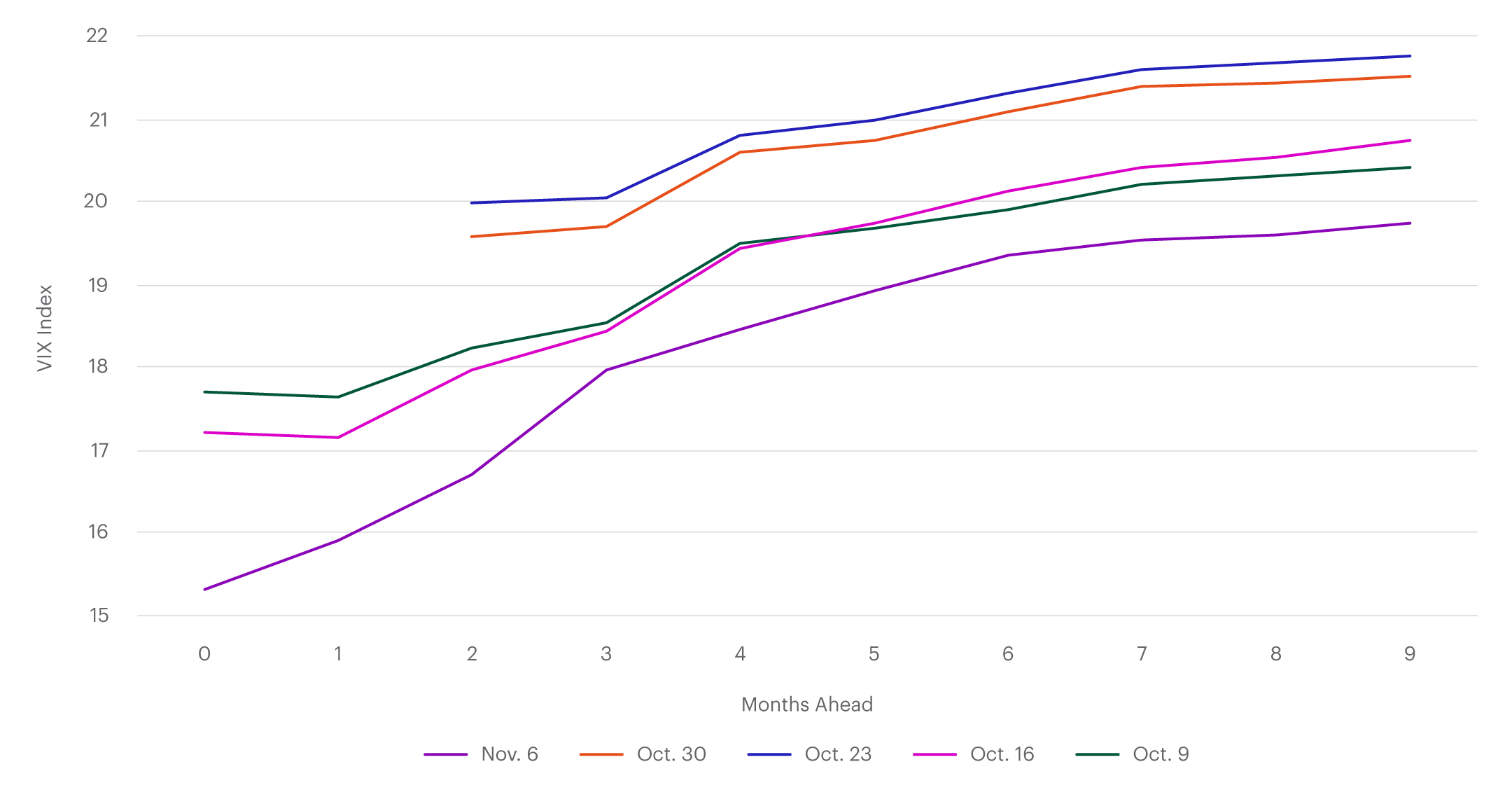

Some investors believe that the impact of the wars in Ukraine and in the Middle East will be minimal on today’s global markets. One way you can tell is by looking at the VIX futures curve. Right now, the upward-sloping curve indicates that some investors believe there is more uncertainty in the future than there is now.3

Further, given that the entire VIX futures curve has shifted lower, this indicates that expectations are for volatility to decline in the coming months.

Volatility Could Jump if the Conflict Broadens, but Traders See No Immediate Threat3

Considerations to help safeguard your portfolio

In times of conflict, some investors are often tempted to hedge by pouring funds into safer assets such as:

- global bonds, US treasuries

- the dollar, the Swiss franc,

- gold, or

- stocks in defensive sectors like consumer staples, utilities, and healthcare.

As a result, we may see short-term rallies for those assets or other investments based on news related to current geopolitical conflicts. Assets to watch include:

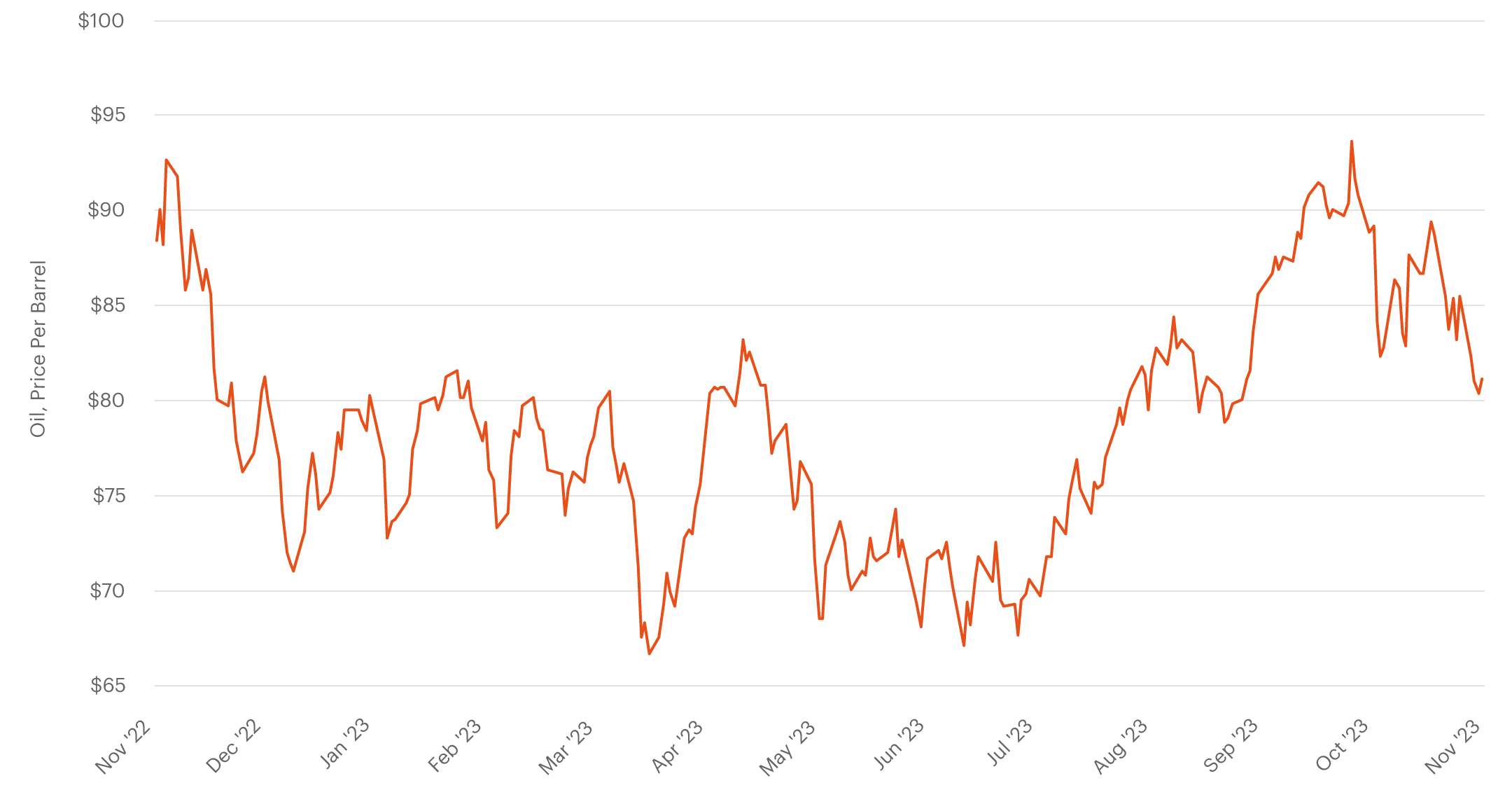

- Oil: Because the Middle East holds half the world’s petroleum reserves, any supply disruptions in the energy sector due to a broader conflict would likely impact the price of oil. While oil was at just over $80 per barrel prior to the start of the Middle East conflict, the World Bank recently warned that a large disruption could drive prices up as high as $157 a barrel.4

Middle East Tensions Have Not Driven Oil Prices Higher4

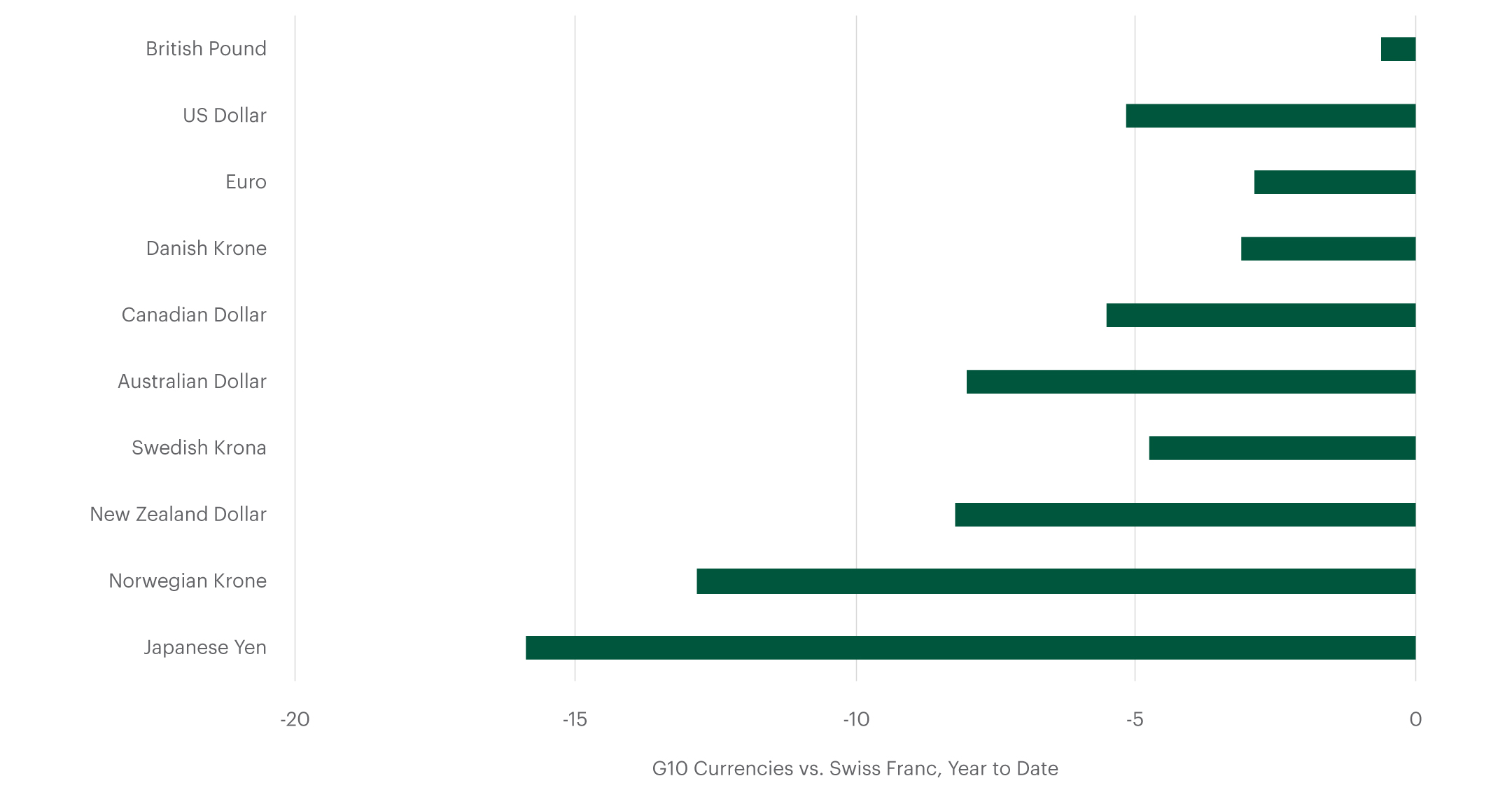

- The Swiss franc: This international currency, like the US dollar, is often considered a defensive investment. The franc is currently outperforming the G10 currencies as investors shift to more conservative investments.5

G10 Currencies Have Weakened Against the Swiss Franc, a Defensive Currency, so Far This Year5

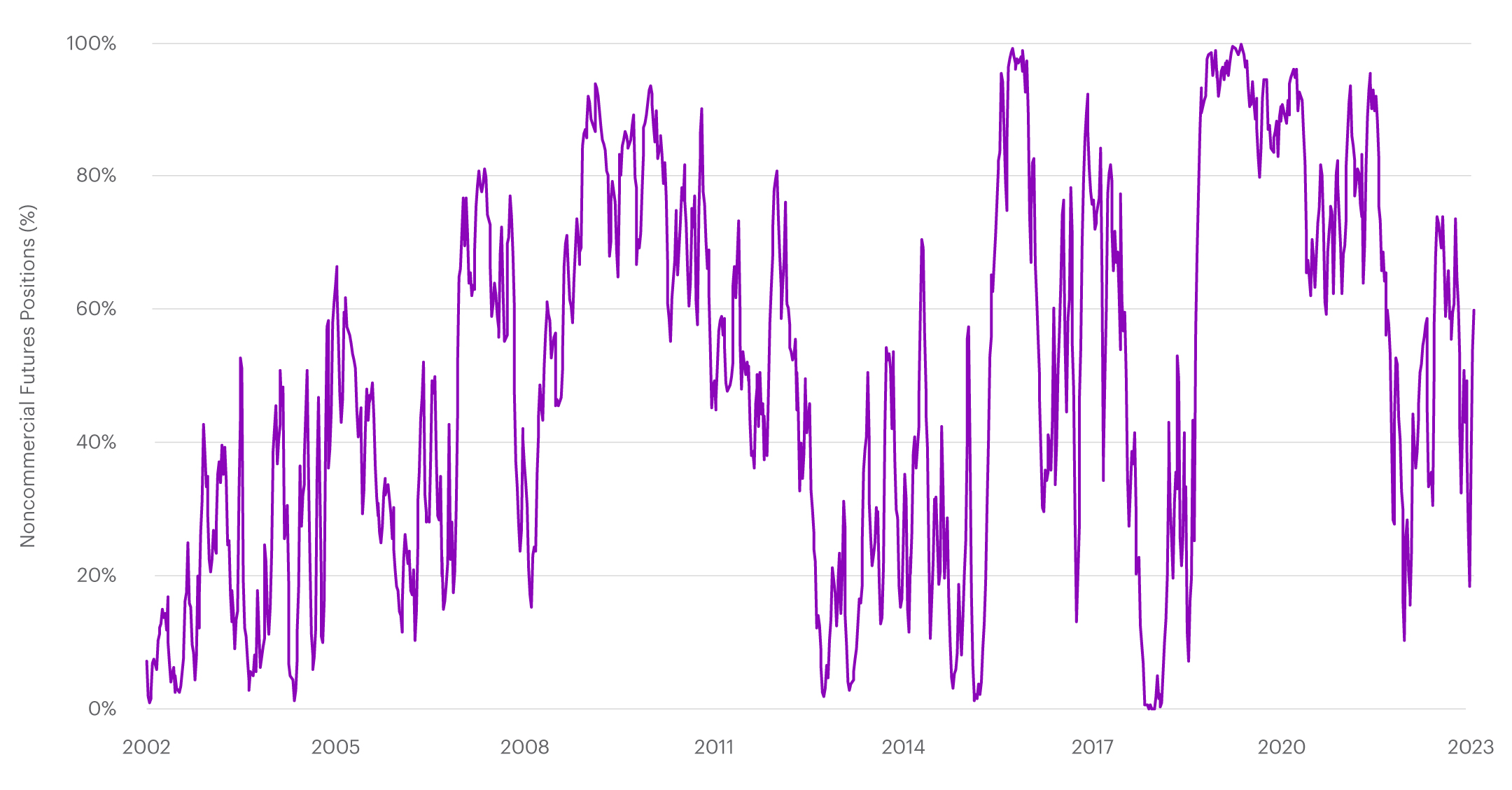

- Gold: Gold is always a popular investment during times of unrest. Given the fact that current investment in gold is not excessively high, the price of gold could go higher as investors seek safety.6

Geopolitical Tensions Fuel a Rally in Gold, but Positioning Is Not Stretched6

The bottom line

Global market returns and volatility are more often based on macroeconomic variables than news of war. Consider ways to diversify your portfolio to help safeguard your returns.

Global market returns and volatility are more often based on macroeconomic variables than news of war. While it may feel like global markets aren’t factoring in the possibility of economic disruption should either the Ukraine or Middle East conflicts broaden in scope, history shows that the market is behaving as expected based on the broader macroeconomic conditions.

Morgan Stanley Wealth Management believes there are several options in light of geopolitical conflict:

- Resist the urge to letting emotions govern your investment behavior;

- Diversify your portfolio to safeguard your returns;

- Stick to your long-term financial plan.

The source of this article, Are Markets Underreacting to Geopolitical Risks?, was originally published on November 8, 2023.

1 Bloomberg, Morgan Stanley Wealth Management Global Investment Office as of Nov. 1, 2023

2 Federal Reserve, Morgan Stanley Wealth Management Global Investment Office as of Nov. 1, 2023

3 Federal Reserve, Morgan Stanley Wealth Management Global Investment Office as of Nov. 1, 2023

4 Bloomberg, Morgan Stanley Wealth Management Global Investment Office as of Nov. 1, 2023

5 Bloomberg, Morgan Stanley Wealth Management Global Investment Office as of Nov. 1, 2023

6 Bloomberg, Morgan Stanley Wealth Management Global Investment Office as of Nov. 1, 2023

How can E*TRADE from Morgan Stanley help?

Energy powerhouses

Find opportunities to invest in firms that are helping to meet the world's energy needs with oil, gas, alternative energy sources, and more.

Playing defense

Find opportunities to invest in companies that may have the ability to weather tough economic times.

Hedging with gold

Discover ways to diversify into a precious metal that many investors consider a potential safe haven when the economy slumps.

Review your portfolio’s allocation and risk

Find out how diversified you are and compare with sample portfolios.